The world’s billionaires are richer than ever. Even with market ups and downs, the increase in tech stocks and strong financial markets led to a new record in billionaire wealth in 2025. The total number of billionaires nearly reached 3,000, and their combined wealth broke the USD 15 trillion barrier for the first time, according to the Billionaire Ambitions Report 2025.

The Americas led the growth in wealth, followed by the Asia-Pacific region. Europe, the Middle East, and Africa trailed but still registered strong gains. Meanwhile, self-made billionaires remained the majority in terms of numbers and total wealth.

Key Takeaways

- Billionaire wealth grew faster than their numbers, which shows that existing billionaires became much richer.

- AI, chips, and cloud businesses emerged as the biggest source of wealth growth.

- The United States and China remained the main centers of billionaire wealth.

Billionaires by Numbers and Total Wealth (2024–2025)

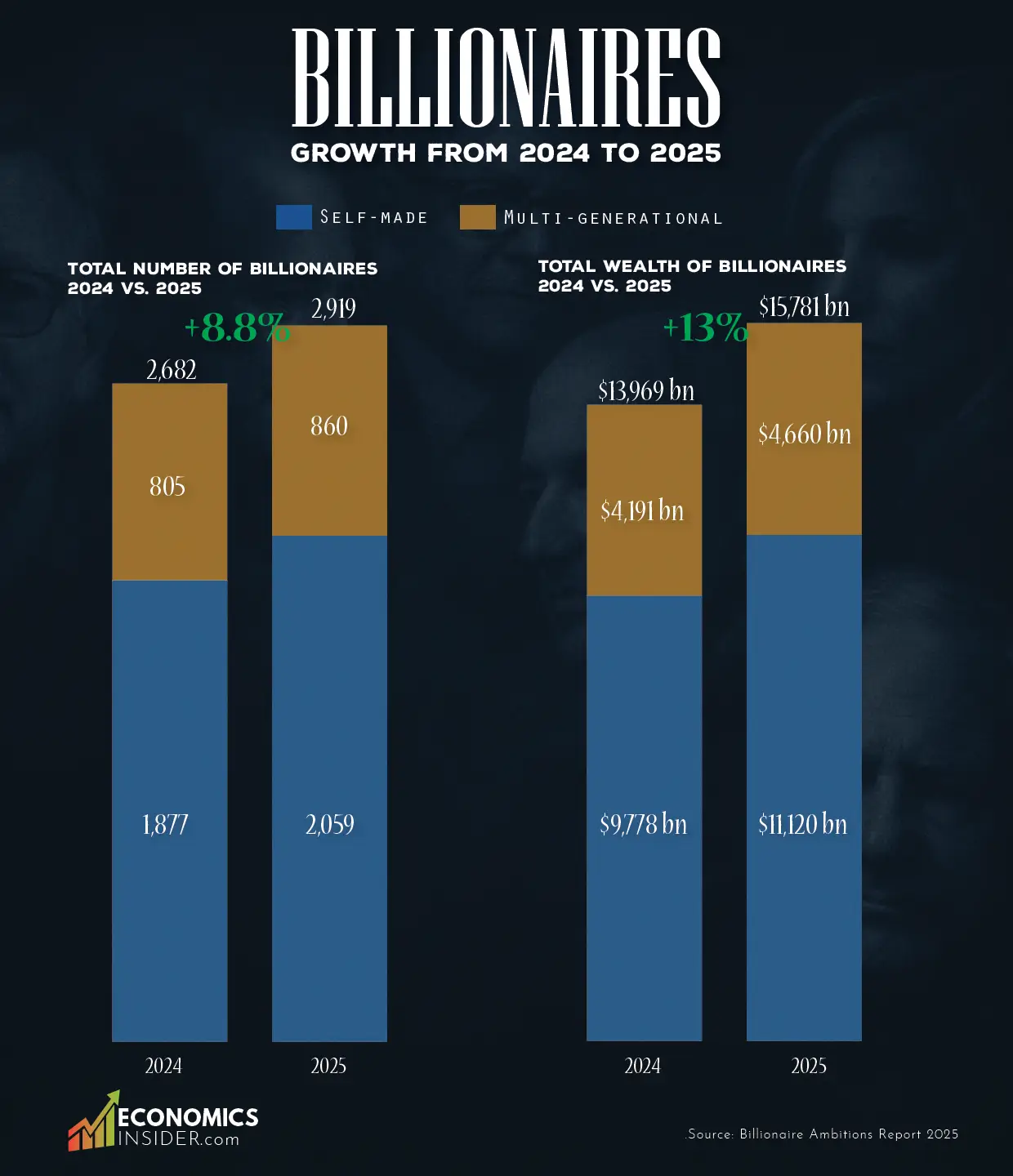

The table below shows how the total number of billionaires and their combined wealth changed from 2024 to 2025.

Total Number of Billionaires

| Category | 2024 | 2025 | Change |

|---|---|---|---|

| Self-made | 1,877 | 2,059 | 182 |

| Multi-generational | 805 | 860 | 55 |

| Total | 2,682 | 2,919 | 8.80% |

Total Billionaire Wealth (USD Billion)

| Category | 2024 | 2025 | Change |

|---|---|---|---|

| Self-made | 9,778.00 | 11,120.70 | 1,342.70 |

| Multi-generational | 4,191.40 | 4,660.40 | 469 |

| Total | 13,969.40 | 15,781.10 | 13% |

Source: Billionaire Ambitions Report 2025

Billionaire Numbers Continue to Rise

As of 2025, the number of billionaires worldwide stood at 2,919, a sharp increase from 2,682 in the previous year. This is an 8.8% rise in just one year. The major chunk of this rise came from self-made billionaires rather than inherited ones.

The number of multi-generational billionaires also rose, but not as sharply. This is an indication that although inherited wealth is still a major factor, new business ventures, investments, and stock market performance are helping to create more new billionaires than ever before.

Total Wealth Grows Even Faster Than Headcount

Though the number of billionaires increased by close to 9%, the overall wealth of billionaires increased by 13% to USD 15.8 trillion. This indicates that the growth in billionaire numbers was outpaced by the growth in billionaire wealth. The main reason for this growth was the sharp rise in asset prices, especially technology stocks and financial assets.

Asia’s Wealth Growth Declines Over 50% in One Decade

Tech Takes the Lead as the Biggest Sector

Technology became the most powerful force behind billionaire wealth growth. Tech billionaires saw their wealth rise by nearly 24%, which added more than USD 580 billion in just one year. This pushed the sector close to USD 3 trillion in total wealth.

Much of this growth came from companies linked to artificial intelligence (AI), cloud services, and chip-making. In the United States, six tech billionaires alone added USD 171 billion to their fortunes due to increased demand for AI-related products and services.

China’s tech sector also made a comeback. The country’s renewed interest in local technology firms and new AI developments helped restore confidence in the “Made in China” tech industry.

Consumer and Retail Lose Momentum

Consumer and retail remained the largest sector by total wealth, at USD 3.1 trillion. However, growth in this sector slowed a lot compared to others. Wealth in this sector grew by 5.3%, far below tech and industrials.

Industrials See the Fastest Growth

The industrials sector saw the biggest increase in billionaire wealth, with a growth of over 27% to USD 1.7 trillion. This was largely due to the reevaluation of SpaceX, which contributed largely to Elon Musk’s increased wealth.

However, growth was not limited to one person. Founders of China’s BYD electric vehicle company also saw major gains. Notably, more than a quarter of the sector’s wealth increase came from new billionaires.

Financial Services Benefit from Markets and Crypto

Billionaires in the financial services industry also had a great year. Wealth in this industry increased by 17% to USD 2.3 trillion. This was due to rising stock markets and an increase in crypto prices.

More than 80% of wealth in financial services belongs to self-made billionaires. Gains were spread across trading, brokerage, private markets, fintech, and digital assets, showing broad-based strength rather than reliance on one area.

Americas Lead Global Wealth Growth

Geographically, the Americas led the way. Billionaire wealth in the region grew by 15.5% to USD 7.5 trillion. The United States was the clear standout within the region.

US billionaire wealth jumped by 18% to USD 6.9 trillion. The number of billionaires in the US increased by 89 to 924, which is almost a third of the total number of billionaires in the world.

Asia-Pacific Shows Strong Momentum

The Asia-Pacific region was a close second, with the total value of billionaires’ wealth increasing by 11.1% to USD 4.2 trillion. The Chinese economy was a significant contributor, particularly with the revival of the tech industry.

There was renewed confidence in the Chinese innovation and electric vehicle industry, which helped boost the economy and reverse the trend of weakness experienced in the past years.

Mixed Picture in Latin America

Not all regions shared in the gains. Central and South America saw billionaire wealth fall by more than 11% to USD 364.5 billion. Brazil and Mexico were the main drags.

In Brazil, falling asset values pushed many older billionaires below the threshold, while only one new billionaire emerged. Mexico also saw more declines than gains, showing how local economic and market conditions can strongly affect wealth.

Conclusion

In summary, 2025 was a record-breaking year for billionaire wealth worldwide. This is due to the rise in technology stocks, robust financial markets, and the creation of new wealth. Although the rate of growth was not consistent in all regions and industries, it is evident that wealth is becoming more concentrated among those who are associated with technology, finance, and growing industries.