According to the Union Bank of Switzerland’s (UBS), the past 30 years have seen a significant increase in the number of billionaires worldwide. While some billionaires inherited their wealth across generations, many have built their fortune from scratch. This high increase in billionaires is mainly due to the rise of the technology industry, strong financial markets, and higher real estate values.

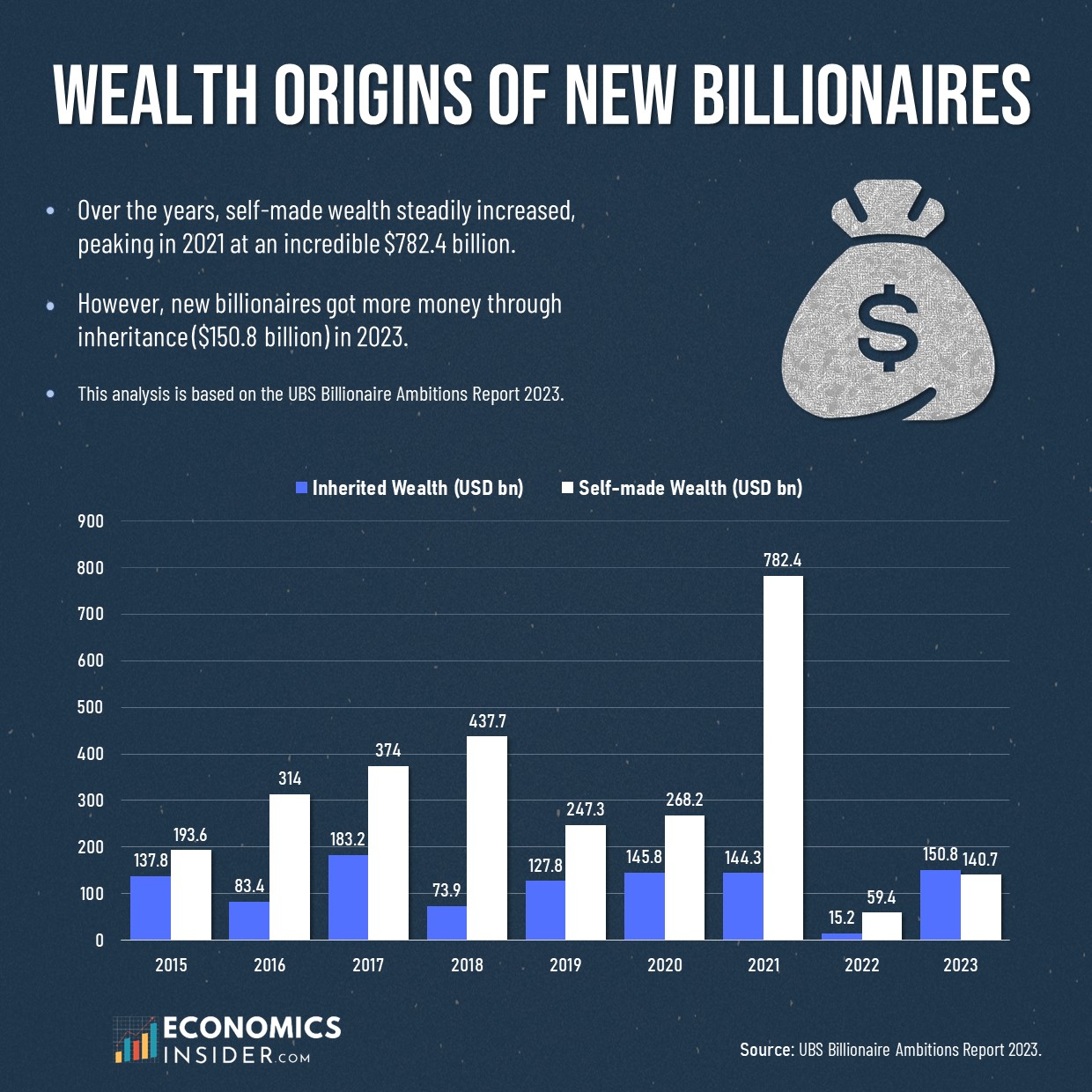

Inherited and Self-Made Wealth Among New Billionaires

The table below provides an overview of inherited and self-made wealth among new billionaires from 2015 to 2023. This table is based on the Union Bank of Switzerland’s (UBS) Billionaire Ambitions Report 2023.

| Year | Inherited Wealth (USD bn) | Self-made Wealth (USD bn) |

|---|---|---|

| 2015 | 137.8 | 193.6 |

| 2016 | 83.4 | 314 |

| 2017 | 183.2 | 374 |

| 2018 | 73.9 | 437.7 |

| 2019 | 127.8 | 247.3 |

| 2020 | 145.8 | 268.2 |

| 2021 | 144.3 | 782.4 |

| 2022 | 15.2 | 59.4 |

| 2023 | 150.8 | 140.7 |

The data is sourced from the UBS.

According to the report, in 2015, inherited wealth was $137.8 billion, while self-made wealth was higher at $193.6 billion during the same year. Additionally, that year, 40 billionaires inherited their wealth, while 71 made their own fortunes. Over time, self-made wealth kept growing, reaching an impressive $782.4 billion in 2021, with 360 self-made billionaires.

Self-Made Wealth

The rise in self-made wealth shows how entrepreneurship, innovation, and technology have played a big role in creating new billionaires. In 2016, self-made wealth increased to $314 billion, adding 83 new billionaires. By 2021, it had jumped to a record $782.4 billion, with 360 billionaires making their own wealth. This massive growth happened because of strong financial markets, new technological advancements, and more investment in startups and businesses.

However, slow IPO markets in 2022 and early 2023 made it harder for entrepreneurs to make money from their businesses. This could explain the drop in self-made wealth to $59.4 billion in 2022. Additionally, it increased to $140 billion in 2023, but it was relatively low as compared to inhereted wealth of $150 billion during the same period.

Global Population Change by Generation in 2035

Inherited Wealth

Inherited wealth has faced a more tumultuous path as it continuously remained lower than self-made wealth except 2023. In 2017, inherited wealth reached its highest point at $183.2 billion but dropped in the following years, hitting its lowest in 2022. However, in 2023, people who inherited wealth received more money ($150.8 billion) than those who built their own businesses ($140.7 billion). This was the first time in the UBS study’s history that inherited wealth exceeded wealth gained through entrepreneurship.

Interestingly, regional data shows the growing significance of inherited wealth. In Asia-Pacific (APAC), inheritors’ average wealth was $2.0 billion, ahead of entrepreneurs’ $1.6 billion. In the Americas, inheritors averaged $2.2 billion versus entrepreneurs’ $1.5 billion. In Europe, the Middle East, and Africa (EMEA), inheritors’ average wealth was $4.4 billion—double the entrepreneurs’ $2.2 billion.

Conclusion

In summary, from 2015 to 2023, both inherited and self-made wealth experienced various highs and lows. While self-made wealth has experienced remarkable growth during this period, inherited wealth has faced a more tumultuous path. However, for the first time in the UBS study’s history, spanning 2015-2023, the inherited wealth exceeded self-made wealth in 2023.

Add Comment