Consumer sentiment in the United States has fallen sharply, reaching one of the lowest levels ever recorded. According to the University of Michigan’s survey, the Consumer Sentiment Index moved down to 50.3 in November. This is dangerously close to the all-time low of 50.0 seen in June 2022. Generally speaking, when consumer sentiment falls this far, people are really concerned and stressed while feeling uncertain about the future of the economy. Furthermore, families could be spending less, businesses may slow their pace, and economic growth may weaken.

Key Takeaways

- The University of Michigan’s Consumer Sentiment Index fell to 50.3 in November, down from 53.6 in October — the lowest since June 2022.

- People of all ages and income levels are feeling less hopeful about the economy.

- Worries about money, jobs, inflation, and government problems are making people anxious.

What is Consumer Sentiment Really Means

Consumer sentiment is basically a measure of how people feel about the economy. It shows whether people think things are getting better or worse, both right now and in the near future. When confidence is high, people feel safe about spending money, buying homes, investing, or planning big purchases. When confidence is low, people hold back. They worry about losing their job, worry about rising prices, and worry about whether the economy might enter a recession.

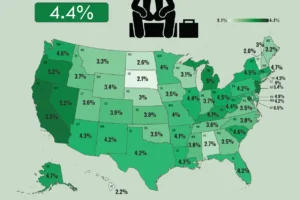

In November, the index reading of 50.3 shows that Americans are extremely unhappy with economic conditions. It is very rare for this number to fall so close to the record low. This means the stress is widespread. It is not only one group of people. It includes young people, older people, families with low income, families with high income, Democrats, and Republicans. Everyone is feeling some level of uncertainty and pressure.

U.S. Consumer Sentiment Drops to a Near-Record Low

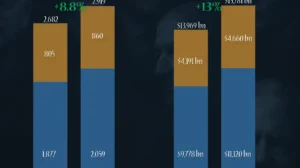

The following table shows how U.S. consumer sentiment has recently dropped to one of its lowest levels on record. The data is taken from the University of Michigan’s Consumer Sentiment Index, which tracks how confident Americans feel about their financial situation and the economy.

| Month (2025) | Consumer Sentiment |

|---|---|

| Apr-25 | 52.2 |

| May-25 | 52.2 |

| Jun-25 | 60.7 |

| Jul-25 | 61.7 |

| Aug-25 | 58.2 |

| Sep-25 | 55.1 |

| Oct-25 | 53.6 |

| Nov-25 | 50.3 |

There are many simple reasons behind this drop in consumer sentiment. The average American is facing multiple problems at the same time. Prices remain high, many households are struggling to pay bills, the job market is weakening, and the government shutdown has created more fear than expected. When all of these factors come together, the result is a deep fall in confidence.

The Impact of the Government Shutdown

One of the biggest reasons behind the fall in confidence is the ongoing U.S. government shutdown. The U.S. government was shut down from October 1 to November 12, 2025, lasting about 43 days, which was the longest in history. About 900,000 government workers were put on leave without pay, and many others had to work without getting paid. Many government services stopped, including benefit payments and data collection. The shutdown caused problems for many people: paychecks were delayed, food aid programs slowed, important economic reports were delayed, and even flights were affected.

Rising Prices Are Hurting People

U.S. inflation is around 3%. Even though inflation is not rising at the same fast pace as before, prices are still very high compared to a few years ago. In simple terms, people feel like their salaries are not keeping up with the cost of living. Many households feel stuck because everything from groceries to rent to fuel remains expensive.

Short-term inflation expectations have slightly increased. This means people believe that prices will continue to rise in the next twelve months. When people expect higher inflation, they feel uncomfortable spending money. They tighten their budgets and avoid unnecessary purchases. Long-term inflation expectations have slightly decreased, which means people hope things will get better eventually. But right now, that hope is not enough to lift their confidence.

The Job Market Is Starting to Show Cracks

The U.S. job market was very strong for the last few years, but now there are signs of weakness. Because of the government shutdown, official job numbers for the latest month were not released. However, several private reports and independent surveys suggest that hiring has slowed down. Some companies have already started cutting jobs. Several analysts mentioned that job cuts in October were higher than usual for that month.

Another problem is wages. While wages have increased over the last few years, many people feel that their income is not rising fast enough to match their expenses. With higher rents, higher bills, and higher debt payments due to high interest rates, the average worker feels financially stressed.

Debt and Higher Interest Rates Add More Pressure

American households are carrying more debt than before. The total household debt in the U.S. has reached about $18.59 trillion (as of Q3 2025). Credit card balances are at record levels. Auto loans and mortgage payments have become more expensive due to high interest rates. When interest rates rise, the cost of borrowing goes up. That means people pay more each month while getting nothing extra in return.

Many families are now spending a big part of their income simply paying interest. This reduces the amount of money available for savings, travel, shopping, or big purchases. When debt pressure increases, people feel insecure. They worry about losing their job because even a small income loss can put them into financial trouble. This fear plays a major role in pulling down consumer confidence.

Growing Fear About a Possible Recession

Because of the government shutdown, high inflation, and worsening job market signals, many households now believe that a recession might happen sometime soon. A recession means job losses, lower spending, and slower economic growth. Even if experts do not agree on whether a recession is coming, people still feel anxious when they hear constant negative news.

When the general mood turns negative, consumer sentiment drops even more. The fear of recession becomes a self-fulfilling cycle. People spend less to protect themselves. Businesses earn less and respond by cutting jobs. Spending decreases further. This puts downward pressure on the overall economy.

Conclusion

The sharp drop in U.S. consumer sentiment shows that people across the country are feeling heavy economic pressure. High prices, job fears, rising debt, political uncertainty, and the ongoing government shutdown have all combined to create a very low mood among households.

Even though the economy is not in a recession, the emotional impact on families is real. People feel insecure, and insecurity spreads quickly. For the economy to strengthen again, confidence must improve. That will require stable government action, clear economic direction, and relief from high living costs.