Financial centers play a major role in shaping the global economy. They are home to the world’s leading financial institutions, markets, and services. According to the latest Global Financial Centres Index, New York City has once again emerged as the world’s most powerful financial center globally.

Additionally, the United States and China have the highest number of cities ranked as top financial centers. The United States dominates the ranking with eight cities in the top 30 financial centers. China also performs strongly well with five cities in the top 35. Meanwhile, the Asia/Pacific region and Western Europe stand out as the leading regions, together accounting for the majority of the top 50 financial centers.

Key Takeaways

- New York City retains its position as the top-ranked financial centre in the world, solidifying its dominance in global finance.

- Asia’s financial landscape is growing rapidly, with cities such as Shanghai, Shenzhen, and Singapore performing well and rising through the ranks.

- Western Europe, led by London, boasts the most financial centres in the top 50 than any other region.

Methodology

The Global Financial Centres Index released on March 2025. It places 119 financial centers by their competitiveness using a blend of 140 quantitative factors and more than 31,000 assessments by financial professionals. The index is refreshed every six months in March and September and relies on data from institutions such as the World Bank, OECD, and United Nations. The GFCI rank is based on factors like business environment, skilled workers, infrastructure, financial industry growth, and overall reputation.

Leading Financial Centers In the World 2025

The following table shows the rankings of world’s financial centers. It displays each city’s present rank, its name, and its respective country and region.

| Rank | Centre | Country / Region |

|---|---|---|

| 1 | New York | United States / North America |

| 2 | London | United Kingdom / Western Europe |

| 3 | Hong Kong | China / Asia/Pacific |

| 4 | Singapore | Singapore / Asia/Pacific |

| 5 | San Francisco | United States / North America |

| 6 | Chicago | United States / North America |

| 7 | Los Angeles | United States / North America |

| 8 | Shanghai | China / Asia/Pacific |

| 9 | Shenzhen | China / Asia/Pacific |

| 10 | Seoul | South Korea / Asia/Pacific |

| 11 | Frankfurt | Germany / Western Europe |

| 12 | Dubai | UAE / Middle East & Africa |

| 13 | Washington DC | United States / North America |

| 14 | Dublin | Ireland / Western Europe |

| 15 | Geneva | Switzerland / Western Europe |

| 16 | Luxembourg | Luxembourg / Western Europe |

| 17 | Paris | France / Western Europe |

| 18 | Amsterdam | Netherlands / Western Europe |

| 19 | Boston | United States / North America |

| 20 | Beijing | China / Asia/Pacific |

| 21 | Zurich | Switzerland / Western Europe |

| 22 | Tokyo | Japan / Asia/Pacific |

| 23 | Toronto | Canada / North America |

| 24 | Busan | South Korea / Asia/Pacific |

| 25 | Jersey | Jersey / Western Europe |

| 26 | Miami | United States / North America |

| 27 | Montreal | Canada / North America |

| 28 | Melbourne | Australia / Asia/Pacific |

| 29 | Edinburgh | United Kingdom / Western Europe |

| 30 | Sydney | Australia / Asia/Pacific |

| 31 | Vancouver | Canada / North America |

| 32 | Glasgow | United Kingdom / Western Europe |

| 33 | Lugano | Switzerland / Western Europe |

| 34 | Guangzhou | China / Asia/Pacific |

| 35 | Qingdao | China / Asia/Pacific |

| 36 | San Diego | United States / North America |

| 37 | Berlin | Germany / Western Europe |

| 38 | Abu Dhabi | UAE / Middle East & Africa |

| 39 | Chengdu | China / Asia/Pacific |

| 40 | Osaka | Japan / Asia/Pacific |

| 41 | Guernsey | Guernsey / Western Europe |

| 42 | Atlanta | United States / North America |

| 43 | Minneapolis / St Paul | United States / North America |

| 44 | Calgary | Canada / North America |

| 45 | Hamburg | Germany / Western Europe |

| 46 | GIFT City-Gujarat | India / Asia/Pacific |

| 47 | Copenhagen | Denmark / Western Europe |

| 48 | Munich | Germany / Western Europe |

| 49 | Wellington | New Zealand / Asia/Pacific |

| 50 | Stockholm | Sweden / Western Europe |

| 51 | Kuala Lumpur | Malaysia / Asia/Pacific |

| 52 | Mumbai | India / Asia/Pacific |

| 53 | Madrid | Spain / Western Europe |

| 54 | Milan | Italy / Western Europe |

| 55 | Isle of Man | Isle of Man / Western Europe |

| 56 | Casablanca | Morocco / Middle East & Africa |

| 57 | Rome | Italy / Western Europe |

| 58 | Mauritius | Mauritius / Middle East & Africa |

| 59 | Oslo | Norway / Western Europe |

| 60 | New Delhi | India / Asia/Pacific |

| 61 | Helsinki | Finland / Western Europe |

| 62 | Brussels | Belgium / Western Europe |

| 63 | Hangzhou | China / Asia/Pacific |

| 64 | Astana | Kazakhstan / Eastern Europe & Central Asia |

| 65 | Tel Aviv | Israel / Middle East & Africa |

| 66 | Stuttgart | Germany / Western Europe |

| 67 | Vienna | Austria / Western Europe |

| 68 | Malta | Malta / Western Europe |

| 69 | Liechtenstein | Liechtenstein / Western Europe |

| 70 | Taipei | Taiwan / Asia/Pacific |

| 71 | Riyadh | Saudi Arabia / Middle East & Africa |

| 72 | Kigali | Rwanda / Middle East & Africa |

| 73 | Doha | Qatar / Middle East & Africa |

| 74 | Dalian | China / Asia/Pacific |

| 75 | Bahrain | Bahrain / Middle East & Africa |

| 76 | Nanjing | China / Asia/Pacific |

| 77 | Reykjavik | Iceland / Western Europe |

| 78 | Sao Paulo | Brazil / Latin America & the Caribbean |

| 79 | Wuhan | China / Asia/Pacific |

| 80 | Kuwait City | Kuwait / Middle East & Africa |

| 81 | Gibraltar | Gibraltar / Western Europe |

| 82 | Tianjin | China / Asia/Pacific |

| 83 | Monaco | Monaco / Western Europe |

| 84 | Cape Town | South Africa / Middle East & Africa |

| 85 | Lisbon | Portugal / Western Europe |

| 86 | Cayman Islands | Cayman Islands / Latin America & the Caribbean |

| 87 | Bermuda | Bermuda / Latin America & the Caribbean |

| 88 | Johannesburg | South Africa / Middle East & Africa |

| 89 | Tallinn | Estonia / Eastern Europe & Central Asia |

| 90 | Cyprus | Cyprus / Eastern Europe & Central Asia |

| 91 | Xi’an | China / Asia/Pacific |

| 92 | Riga | Latvia / Eastern Europe & Central Asia |

| 93 | Barbados | Barbados / Latin America & the Caribbean |

| 94 | Rio de Janeiro | Brazil / Latin America & the Caribbean |

| 95 | Almaty | Kazakhstan / Eastern Europe & Central Asia |

| 96 | Bangkok | Thailand / Asia/Pacific |

| 97 | Jakarta | Indonesia / Asia/Pacific |

| 98 | Ho Chi Minh City | Vietnam / Asia/Pacific |

| 99 | Santiago | Chile / Latin America & the Caribbean |

| 100 | Nairobi | Kenya / Middle East & Africa |

| 101 | Warsaw | Poland / Eastern Europe & Central Asia |

| 102 | British Virgin Islands | British Virgin Islands / Latin America & the Caribbean |

| 103 | Manila | Philippines / Asia/Pacific |

| 104 | Tehran | Iran / Middle East & Africa |

| 105 | Lagos | Nigeria / Middle East & Africa |

| 106 | Prague | Czech Republic / Eastern Europe & Central Asia |

| 107 | Istanbul | Turkey / Eastern Europe & Central Asia |

| 108 | Trinidad and Tobago | Trinidad and Tobago / Latin America & the Caribbean |

| 109 | Athens | Greece / Eastern Europe & Central Asia |

| 110 | Mexico City | Mexico / Latin America & the Caribbean |

| 111 | Bahamas | Bahamas / Latin America & the Caribbean |

| 112 | Panama | Panama / Latin America & the Caribbean |

| 113 | Sofia | Bulgaria / Eastern Europe & Central Asia |

| 114 | Budapest | Hungary / Eastern Europe & Central Asia |

| 115 | Moscow | Russia / Eastern Europe & Central Asia |

| 116 | Bogota | Colombia / Latin America & the Caribbean |

| 117 | St Petersburg | Russia / Eastern Europe & Central Asia |

| 118 | Baku | Azerbaijan / Eastern Europe & Central Asia |

| 119 | Buenos Aires | Argentina / Latin America & the Caribbean |

The data is sourced from the Global Financial Centres Index.

The above GFCI data provides a holistic picture of the global financial landscape, encompassing 119 financial centers on every continent. The rankings are influenced by a mix of quantitative factors and qualitative assessments. The data shows that while old leaders retain their superiority in financial services, emerging markets are rapidly closing the gap.

Top 10 Financial Centers: A Closer Look

1. New York City (United States / North America)

New York remains unrivaled as one of the most powerful global financial centers in the world. Home to the New York Stock Exchange (NYSE) and NASDAQ, it boasts the greatest accumulation of capital worldwide. It leads in investment banking, asset management, private equity, and fintech. Despite global volatility, its legal environment, regulatory transparency, and infrastructure continues to provide unparalleled stability and investor confidence.

2. London (United Kingdom / Western Europe)

London is Europe’s financial hub. Despite the turbulence caused by Brexit, London is still a world leader in foreign exchange dealing, insurance, and legal services. Additionally, it remains a magnet for global institutions because it is in a time zone that acts as a bridge between Asia and America.

The presence of the Bank of England, Lloyd’s of London, and UK’s robust legal system further strengthens its financial position.

3. Hong Kong (China / Asia-Pacific)

Hong Kong has always been the financial conduit between mainland China and the global community. Despite political and economic turmoil in recent times, its banking system is still holding up well. Hong Kong still leads in initial public offerings (IPOs), asset management, and cross-border finance.

Additionally, its tax policy, strong legal system, and access to Asian and Western markets render it extremely competitive. The strategic location of the city and its inclusion in the Greater Bay Area continues to enhance its importance and global relevance in finance.

4. Singapore (Singapore / Asia-Pacific)

Singapore is among the most business-friendly places on earth. Its political stability, low corruption rates, and great infrastructure have made it the preferred destination for multinational banks and fintech startups in Southeast Asia.

5. San Francisco (United States / North America)

San Francisco, known as the gateway to Silicon Valley, stands out by blending traditional financial services with cutting-edge technology. It is a world leader in fintech, venture capital, and startup financing.

Although it doesn’t compete with New York in institutional finance, its position as a leader in the future of finance through blockchain, crypto, and AI-based solutions places it in a class by itself.

Top 15 Largest US Treasury Holders in 2025: Who Owns America’s Debt?

6. Chicago (United States / North America)

Chicago has been a critical centre for commodities and derivatives trading for many years. The city is home to the Chicago Mercantile Exchange (CME) and Chicago Board Options Exchange (CBOE) and plays a crucial role in global risk management and trading. It is also a regional hub for a number of financial powerhouses and continues to benefit from being geographically positioned at the center of North America.

7. Los Angeles (United States / North America)

Los Angeles may be famous for Hollywood, but it is also emerging in real estate finance, venture capital, and international banking. Its ties to the Asia-Pacific region and deep capital base make it an influential West Coast financial player. With more investment in technology-driven finance and green energy markets, L.A. is broadening its reputation among the leading financial centers in the world.

8. Shanghai (China / Asia-Pacific)

Shanghai is the financial hub of China. It is home to the Shanghai Stock Exchange, one of the largest stock exchanges in the world by market capitalization. Shahangai is gradually emerging as an international financial hub, with a major emphases on bond markets, asset management, and fintech innovation.

9. Shenzhen (China / Asia-Pacific)

Shenzhen is commonly referred to as the home of Tencent and Ping An Insurance and is closely linked to digital banking, technology-backed insurance, and venture capital. It is geographically well-positioned within the Greater Bay Area, which links Hong Kong, Macau, and other southern Chinese cities.

10. Seoul (South Korea / Asia-Pacific)

Seoul stands out for its strong performance in fintech, digital payments, and banking innovation. South Korea’s regulatory environment and high Internet penetration rates promote financial ecosystem in the country. Additionally, Seoul is also becoming a hub for ESG (Environmental, Social, and Governance) investing, and capital markets, particularly for institutional investors across Northeast Asia.

Important Regions Driving the World’s Finance

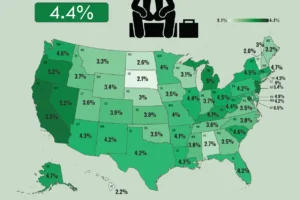

North America

North America remains at the forefront of global finance. The United States alone boasts eight cities in the top 30 financial centers due to its unparalleled depth of capital markets, technology, and regulation. Canada adds cities such as Toronto, Vancouver, and Montreal, which are significant financial centers for North American and international investment.

Asia/Pacific

Asia is the most vibrant zone in the rankings. Metro cities such as Hong Kong, Singapore, Shanghai, and Shenzhen are not only competitive financial centers but they also investing heavily in future growth sectors such as digital currency and green finance. Even metropolitans like Busan, GIFT City-Gujarat, and Kuala Lumpur are being recognized as rising financial hubs in Asia.

Western Europe

Despite economic uncertainties, Western Europe is still a hub of international finance. London remains at the forefront, aided by cities such as Frankfurt, Zurich, Paris, and Amsterdam. The region enjoys profound historical financial foundations and robust legal systems.

Middle East & Africa

The Middle East is also rising fast, with Dubai, Abu Dhabi, and Riyadh placing strong appearances in global finance. They are turning into worldwide hubs for Islamic finance, sovereign wealth funds, and infrastructure investment. Africa is also picking up steam with Cape Town, Nairobi, and Casablanca as strong financial hubs.

Latin America & the Caribbean

This region’s financial landscape is diverse. São Paulo and Mexico City are the main financial centres in the region, while Caribbean locations like the Cayman Islands and the Bahamas play a key role in offshore banking and financial services.

Conclusion

The GFCI provides a comprehensive picture of the global financial centers in 2025. New York, London, and Hong Kong continue to dominate the global ranking of top financial institutions. Asia and the Middle East are growing rapidly in financial landscape. Digitalization, transparency, regulatory reforms, and regional integration are the most important trends that shapes the success of financial centres nowadays.

Add Comment