A few countries hold huge amounts of foreign exchange reserves — the money and assets a country keeps in foreign currencies to protect its economy. China holds the largest reserves with around $3.4 trillion. Japan has the second largest reserves with about $1.2 trillion. Together, China and Japan alone hold nearly $4.7 trillion, which is more than the combined reserves of many other major economies.

The U.S. dollar has long been the most important reserve currency in the world. It is used by central banks for their reserves, and by countries for global trade, loans, and investments. However, over the past few years, the dollar’s dominance has been slowly shrinking. Central banks in many countries are starting to diversify their reserves across other major currencies like the euro, yen, or Chinese yuan, and also investing more in gold and other assets.

Key Takeaways

- China and Japan hold the most foreign exchange reserves in the world. Together, they have around $4.7 trillion, which shows the financial strength of the two Asian economies.

- The U.S. dollar is still the main reserve currency, but more countries are now adding euros, yen, and yuan to their reserves.

- Global finance is slowly moving toward a more balanced system, where economic influence is spread across several strong currencies.

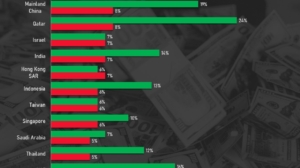

Countries With Largest Foreign Exchange Reserves

The following table lists the top 25 countries with the largest foreign exchange reserves in the world, based on the latest estimates from the World Factbook.

| Rank | Country | Foreign Exchange Reserves |

|---|---|---|

| 1 | 🇨🇳 China | $3.5 trillion |

| 2 | 🇯🇵 Japan | $1.2 trillion |

| 3 | 🇺🇸 United States | $910 billion |

| 4 | 🇨🇭 Switzerland | $909 billion |

| 5 | 🇮🇳 India | $643 billion |

| 6 | 🇷🇺 Russia | $597 billion |

| 7 | 🇸🇦 Saudi Arabia | $463 billion |

| 8 | 🇭🇰 Hong Kong | $425 billion |

| 9 | 🇰🇷 South Korea | $418 billion |

| 10 | 🇸🇬 Singapore | $383 billion |

| 11 | 🇩🇪 Germany | $377 billion |

| 12 | 🇧🇷 Brazil | $329 billion |

| 13 | 🇮🇹 Italy | $290 billion |

| 14 | 🇫🇷 France | $282 billion |

| 15 | 🇦🇪 United Arab Emirates | $237 billion |

| 16 | 🇹🇭 Thailand | $236 billion |

| 17 | 🇲🇽 Mexico | $232 billion |

| 18 | 🇵🇱 Poland | $223 billion |

| 19 | 🇮🇱 Israel | $214 billion |

| 20 | 🇬🇧 United Kingdom | $174 billion |

| 21 | 🇮🇩 Indonesia | $155 billion |

| 22 | 🇹🇷 Turkey (Türkiye) | $154 billion |

| 23 | 🇨🇿 Czechia | $146 billion |

| 24 | 🇨🇦 Canada | $119 billion |

| 25 | 🇲🇾 Malaysia | $116 billion |

1. China 🇨🇳

China possesses the largest foreign exchange reserve stockpile globally — approximately $3.46 trillion as of 2024. This enormous amount of money is the result of decades of trade surpluses as China exports significantly more goods than it imports. China’s export-oriented economy and strict control over money flows have enabled it to accumulate and retain enormous reserves.

China accumulates such reserves for strategic and safety purposes. These funds serve as a financial buffer that enables China to insulate its economy from global crises, currency fluctuations, or political tensions.

Also, a significant share — more than $730 billion — of China’s reserves is held in U.S. Treasury bills, making China one of America’s largest creditors. This also makes China’s financial stability dependent on the U.S. economy, since if there are issues in the U.S., then China’s investments can be impacted as well.

Having such large reserves enables Beijing to stabilize its own currency (the renminbi) if it loses value, gain leverage in trade negotiations, and finance major international projects like the Belt and Road Initiative.

2. Japan 🇯🇵

Japan is second with approximately $1.23 trillion in foreign exchange reserves. The country exports cars, electronics, and machinery to the world. Since it earns more on exports than it spends on imports, over time, it accumulates foreign currency reserves.

These reserves consist of foreign exchange, Special Drawing Rights (SDRs), gold, and other items. The Ministry of Finance and the Bank of Japan maintain these reserves in order to guard the yen (Japan’s currency) from drastic fluctuations and ensure that Japan can pay its foreign bills easily.

3. United States 🇺🇸

The United States holds approximately $910 billion in reserves as of 2024. Unlike most other countries, the U.S. doesn’t need to hold extremely large reserves. That’s because the U.S. dollar is the main currency used around the world for trade, finance, and savings. Other countries want to hold dollars, so the U.S. doesn’t have to stockpile foreign currencies the same way export-driven nations like China or Japan do.

The U.S. government also sells Treasury bonds, which are the safest investments in the world. This grants America a privileged position — it can borrow and swap using its own currency. Policy changes in the U.S., high debt, or political tensions can influence other nations’ reserve management and trust in the dollar.

4. Switzerland 🇨🇭

Switzerland has around $909 billion in reserves. Even though Switzerland’s economy is much smaller than China or Japan, it is a major global financial center. The Swiss franc is considered one of the world’s safest currencies, and during times of global crisis, investors move their money into Switzerland.

Due to these inflows of capital, the Swiss National Bank (SNB) has to intervene and purchase foreign currencies in order to prevent the franc from becoming too powerful — this intervention is called currency intervention. Due to this, Switzerland has accumulated huge reserves over a period of time.

5. India 🇮🇳

India has reserves of approximately $643 billion in 2024. The country has tried its best over the last few years to accumulate its reserves to secure its economy and defend its rupee (currency). These reserves serve as a buffer — enabling it to finance imports, deal with currency fluctuations, and weather financial shocks globally.

For instance, through 2025, India’s reserves would fund approximately 11 months of imports, which is good fiscal security for it. Yet India has some issues, such as a current account deficit (importing more than it exports and earning), vast external borrowing, and overreliance on imported energy.

The Top 15 Manufacturing Countries in the World

6. Russia 🇷🇺

Russia’s reserves stand at an approximate $597 billion. Russia’s situation is special due to international sanctions and frozen funds due to geopolitical tensions. Despite these difficulties, Russia has continued to contribute to its reserves, particularly in gold and non-Western currencies such as the Chinese yuan.

This approach is designed to lower Russia’s reliance on Western financial systems and render its economy increasingly sanction-proof in the future.

7. Saudi Arabia 🇸🇦

Saudi Arabia maintains approximately $463 billion in reserves. The country’s reserves primarily consist of oil export earnings. When the price of oil is high, Saudi Arabia receives a higher amount of dollars, which it invests in foreign assets. The Saudi Central Bank and the sovereign wealth fund manage these reserves.

The reserves assist Saudi Arabia in maintaining the stability of its currency, the riyal. They also offer an economic buffer when oil prices drop or the nation spends a lot on its economic diversification strategies (such as Vision 2030).

8. Hong Kong 🇭🇰

Hong Kong possesses approximately $425 billion in reserves. Although Hong Kong is a tiny territory, it’s one of the global largest financial centers. The Hong Kong dollar is fixed to (or “pegged”) the U.S. dollar via a system known as a currency board.

In order to preserve this connection, Hong Kong’s Monetary Authority (HKMA) needs to hold a vast amount of foreign exchange reserves. These reserves ensure that it can always convert Hong Kong dollars into U.S. dollars, keeping investor confidence intact.

9. South Korea 🇰🇷

South Korea maintains approximately $418 billion in reserves in 2024. The country boasts a very robust export economy — it exports items such as semiconductors, automobiles, and electronics globally. These exports generate significant foreign exchange, enabling the nation to accumulate its reserves.

The Bank of Korea employs these reserves to stabilize the won when necessary and to make sure that the nation is able to service any foreign loans in times of hardship.

10. Singapore 🇸🇬

Singapore maintains approximately $384 billion as of 2024. Although Singapore is a small nation, it possesses an extremely open economy that relies mainly on trade, investment, and finance. Since markets around the world are volatile, Singapore maintains significant reserves as a buffer.

The reserves are handled with care to maintain its managed-float exchange-rate system, that is, the government allows its currency to fluctuate within a managed range rather than completely fixing it.

Other Key Countries and Their Reserves

Aside from the largest reserve holders such as China, Japan, and the U.S., there are numerous other countries that also maintain significant foreign exchange reserves.

For instance, Germany has reserves of approximately $378 billion. Germany is one of the top economies in Europe and maintains a trade surplus that is steady, i.e., it exports more products overseas than it imports. These reserves enable Germany to stabilize its economy and cushion itself against risks that arise from international trade and financial flows within the European Union.

Brazil, with about $330 billion in reserves, is a large emerging market player. Brazil relies extensively on commodity exports like oil, iron ore, and agricultural goods. When the price of such commodities declines, Brazil’s earnings plunge steeply — so maintaining large reserves allows the country to manage these fluctuations.

Other countries, including Italy and the United Arab Emirates (UAE), also have a high level of reserves.

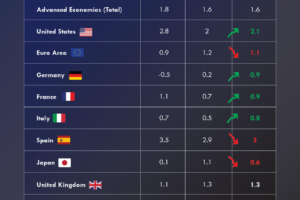

Why the U.S. Dollar’s Dominance Is Gradually Falling

The U.S. dollar has been the central banks’ primary reserve currency around the world. But in recent years, the dominance of the dollar has been gradually falling.

In the early 2000s, approximately 70% of global foreign exchange reserves were in dollars. As of 2022, that percentage declined to a little over 60%. The dollar remains at the top, but the world is slowly diversifying.

Most nations no longer want to rely solely on the U.S. dollar. They are diversifying their reserves into other key currencies such as the euro, Japanese yen, and Chinese yuan, as well as other assets such as gold.

Conclusion

In short, China and Japan have the largest reserves, with other countries like the U.S., Switzerland, and India also holding significant levels of foreign reserves. The top five countries together hold approximately $9 trillion or more in reserves.

Simultaneously, the international system is gradually transforming. The dollar, while it remains supreme, is slowly losing a fraction of its share as nations increasingly diversify into other currencies and assets. This does not indicate that dollar dominance will collapse in the near future — but does indicate a more balanced, multipolar world.