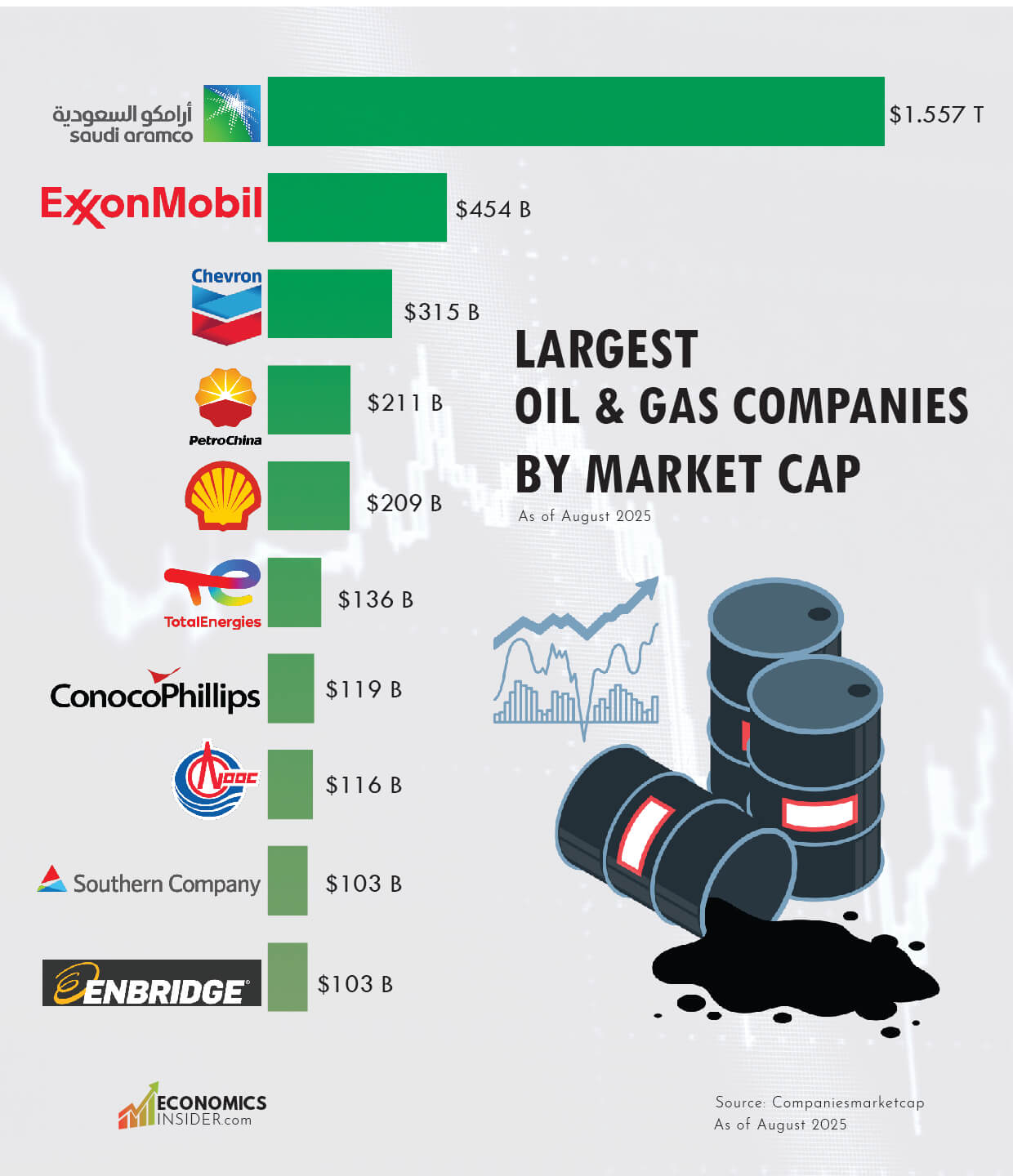

The world’s energy sector is dominated by the Largest Oil and Gas Companies, which control much of the global market. Saudi Arabia’s Aramco is the world’s largest company by market capitalization, worth a whopping $1.5 trillion. Two American giants, Exxon Mobil and Chevron, take the second and third spots as the runners-up.

The United States contributes with the four companies in the top 10 list that have a combined market cap of approximately $991 billion. On the other hand, China is home to two major energy giants — CNOOC and PetroChina. There are other major economies like the United Kingdom, France, Canada, and the UAE, too, with their energy companies featured in the top 10.

Key Takeaways

- Saudi Aramco’s enormous $1.557 trillion valuation makes it the sole trillion-dollar energy firm, which is way beyond the competitors.

- The four American firms in the top 10 have a combined market cap of around $991 billion.

- China keeps on emerging as an energy powerhouse, with PetroChina and CNOOC both being in the top 10.

The Largest Energy Companies

The table below shows the world’s largest oil and gas companies by market capitalization.

| Rank | Company | Market Cap | Country |

|---|---|---|---|

| 1 | Saudi Aramco | $1.557 T | 🇸🇦 Saudi Arabia |

| 2 | Exxon Mobil | $453.99 B | 🇺🇸 USA |

| 3 | Chevron | $315.42 B | 🇺🇸 USA |

| 4 | PetroChina | $210.73 B | 🇨🇳 China |

| 5 | Shell | $209.40 B | 🇬🇧 UK |

| 6 | TotalEnergies | $136.23 B | 🇫🇷 France |

| 7 | ConocoPhillips | $119.06 B | 🇺🇸 USA |

| 8 | CNOOC | $116.33 B | 🇨🇳 China |

| 9 | Southern Company | $103.48 B | 🇺🇸 USA |

| 10 | Enbridge | $102.61 B | 🇨🇦 Canada |

Source: Companies Market cap.

World’s largest oil and gas companies are not just oil manufacturers; they comprise companies engaged in natural gas, electricity generation, and pipelines as well. A few of them are national champions such as Aramco and PetroChina, whereas others such as Exxon Mobil, Chevron, and Shell are publicly traded giants that have shareholders worldwide.

Saudi Aramco (Saudi Arabia 🇸🇦)

Saudi Aramco isn’t merely the world’s largest oil company—it’s one of the most profitable companies in the world. It’s worth more than $1.5 trillion by market capitalization and owns one of the world’s largest proven oil reserves.

Unlike Western oil majors, Aramco is state-owned, which gives Saudi Arabia immense power over global oil markets. Aramco went public in 2019 with one of the world’s largest IPOs and has remained the most valuable energy company ever since.

Exxon Mobil (USA 🇺🇸)

Exxon Mobil is the largest publicly held energy firm in America ranking second with a total market value of $453.99 billion. This US multinational company deals in oil, gas, and chemicals. Even though it has been challenged by issues concerning environmental groups and volatile oil prices, Exxon is still among the key US firms in the global energy sector.

Chevron (USA 🇺🇸)

Chevron is another US energy giant, with a market capitalization of $315 billion. It is famous for its efficient operations and solid base in liquefied natural gas (LNG). Similar to its US counterpart Exxon, Chevron has operations across the entire energy value chain. The firm has operations globally and produces millions of barrels of oil per day. The company also deals in the development of renewable energy.

PetroChina (China 🇨🇳)

PetroChina, China’s largest oil company, is a subsidiary of state-owned China National Petroleum Corporation (CNPC). The firm has a market value of $210 billion, and is among China’s largest state-owned energy firms. It engages in exploration as well as refining, and also contributes significantly in addressing China’s increasing energy demand.

Shell (UK 🇬🇧)

Shell, the British energy firm, remains in the top five with a market cap of $209 billion. It is among Europe’s largest energy firms. Shell has been diversifying into renewables, making investments in wind and solar energy.

Top 15 Largest US Treasury Holders in 2025: Who Owns America’s Debt?

France’s TotalEnergies closely trails with a value of $136 billion and has operations in over 100 nations. Both TotalEnergies and Shell companies are heavily investing in energy transition while still relying on oil and gas as their primary business.

Additionally, ConocoPhillips is a major independent oil and gas firm in the United States. CNOOC is China’s largest offshore oil and gas firm worth $116 billion of market capitalization. Moreover, USA’s Southern Company and Canada’s Enbridge are among the top countries by market cap.

Conclusion

Despite the United States being the biggest producer of oil in 2024, it is Saudi Arabia’s state oil company that that leads the pack among the largest oil and gas companies by market value. At the same time, the U.S. holds a very strong position, with four of its companies appearing in the top 10 and together controlling nearly $1 trillion in market capitalization. China, with state-owned giants PetroChina and CNOOC, also shows its strength in the energy sector.

Add Comment