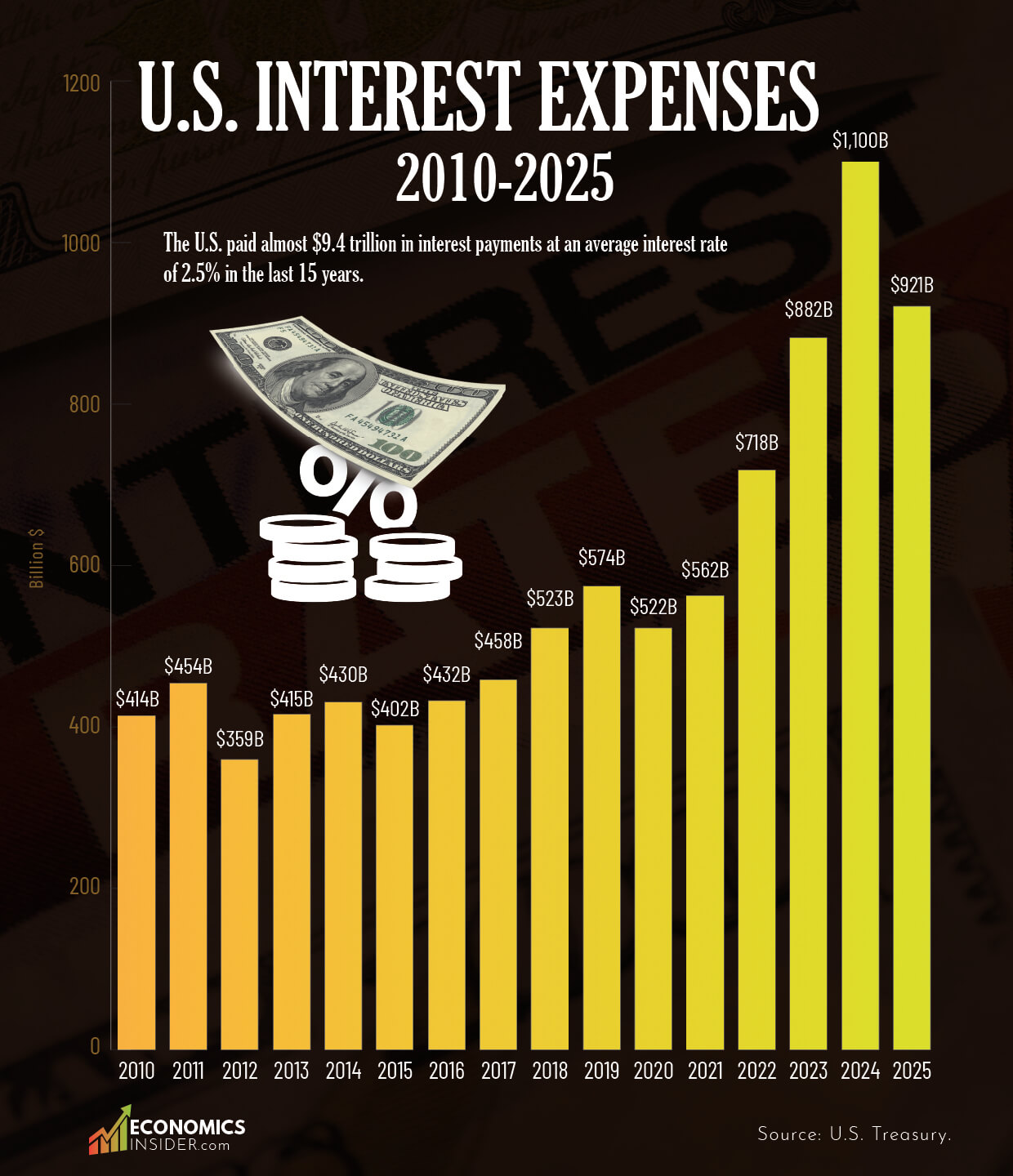

The U.S. national debt is rising rapidly, and by 2025, it is expected to reach almost $37 trillion. With increasing national debt, the interest payments on U.S. Treasury securities have also been rising at a fast pace. The interest payments made by the U.S. government on its debt over the last 15 years are marked by wide fluctuations. In 2024 alone, the US government paid a staggering $1.1 trillion in interest at an average interest rate of 3.3%. In total, the U.S. has paid about $9.4 trillion in interest payments over the last 15 years, with an average interest rate of 2.5%.

To improve the country’s financial health, President Trump recently signed the “One Big Beautiful Bill” act. The bill aims to reduce the country’s fiscal deficit and strengthen America’s financial health in the long run. One of its prominent objectives is to reduce the debt-to-GDP ratio to 94% by 2034. However, critics argue the bill would actually add more than $3 trillion to the already growing U.S. debt, making the situation even more.

Key Takeaways

- The U.S. paid almost $9.4 trillion in interest payments at an average interest rate of 2.5% in the last 15 years.

- Interest rates were lowest in 2021 (1.6%) and highest in 2010 (3.1%) and 2024-2025 (3.3%).

- Surprisingly, when average interest rates were fairly low (for instance, around 1.6% in 2021), interest expenses still remained high because of the high volume of debt.

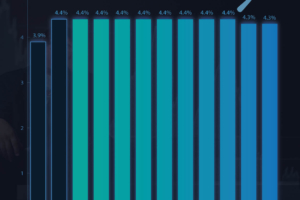

U.S. Interest Payments 2010-2025

The following table indicates the U.S. fiscal year interest expenses on Treasury securities and the corresponding average interest rates.

| Fiscal Year | Interest Expense | Avg. Interest Rate |

|---|---|---|

| 2010 | $414 Billion | 3.1% |

| 2011 | $454.4 Billion | 2.9% |

| 2012 | $359.8 Billion | 2.6% |

| 2013 | $415.7 Billion | 2.4% |

| 2014 | $430.8 Billion | 2.4% |

| 2015 | $402.4 Billion | 2.4% |

| 2016 | $432.6 Billion | 2.2% |

| 2017 | $458.5 Billion | 2.3% |

| 2018 | $523 Billion | 2.5% |

| 2019 | $574.6 Billion | 2.5% |

| 2020 | $522.8 Billion | 1.8% |

| 2021 | $562.4 Billion | 1.6% |

| 2022 | $718.7 Billion | 2.1% |

| 2023 | $882.6 Billion | 3.0% |

| 2024 | $1.1 Trillion | 3.3% |

| 2025 | $921 Billion | 3.3% |

The data is sourced from the U.S. Treasury.

Moderate Interest Costs (2010-2019)

Interest payments varied between 2010 and 2019 but stayed within a reasonable level. In 2010, the government paid $414 billion in interest at an average rate of 3.1%. These rates decreased over a few subsequent years, keeping costs down even as the US debt increased.

By 2015, the interest rate had fallen to an average of 2.4% and interest payments ranged between $400-$450 billion per year. Even as the national debt increased, low borrowing costs prevented a major rise in interest payments. But things began to change at the turn of the decade. In 2018 and 2019, interest expenses rose to $523 billion and $574 billion, respectively.

The Pandemic Effect (2020-2021)

When the COVID-19 pandemic struck in 2020, the government responded with huge expenditures to stabilize the economy. Amazingly, interest costs actually declined to $522 billion, lower than in 2019. This was due to the Federal Reserve slashed rates to all-time lows, reducing the average interest rate to a mere 1.8%.

Rates dropped further in 2021 to 1.6%, maintaining interest payments at $562 billion, still below the pre-pandemic level. At this time, it was assumed that ultra-low rates would continue indefinitely, making debt more sustainable.

The Rising US Interest Expenses

The steepest spike in interest expenses occurred between 2023 and 2024. In 2023, the costs reached over $882 billion with an average rate of 3%, and by 2024, the costs reached $1.1 trillion with a 3.3% rate — the highest within the period.

This was a turning point, marking a new age in which excessive debt and increased rates come together to put pressure on the US budget. Even in 2025, the US interest expenses have reached $921 billion.

Top 25 Countries with the Highest Debt to GDP Ratio in 2025

Why US Interest expenses are increasing?

The increasing interest expenses come directly from U.S. Treasury securities—the bonds, notes, and bills that the government issues to borrow funds. When the U.S. government needs cash, it sells Treasury securities like bills, notes, and bonds to investors.

When investors purchase these Treasuries, they’re effectively lending money to the U.S. government in return for periodic interest payments. For years, rates on these securities stayed low, keeping borrowing costs manageable. But when the Federal Reserve increased interest rates to fight inflation, the Treasury had to offer higher yields to attract buyers.

AS the US national debt grows, the government has to sell more of these securities and pay more in interest, which leads directly to the rising interest expenses. This is why interest expenses explode and every percentage point increase gets multiplied across the $36 trillion debt.

Why This Matters to Americans

Increasing interest payments are one of the emerging challenges faced by the U.S. government. Each dollar used to pay interest means there’s one less dollar available for infrastructure, schools, health care, and national defense. If expenses continue to grow, the government will have to make difficult decisions such as raise taxes, reduce spending, or borrow additional money, which just adds to the debt.

There’s an even larger risk: if investors begin to question whether the U.S. will be able to pay its debt, they will insist on more interest to lend it money. Over time, this could slow economic growth and put more strain on the US budget.

Conclusion

America’s growing interest payments are becoming unsustainable. Interest expenses have not just been substantial but have risen sharply over the last few years. Between 2010 and 2015, yearly interest costs tended to be below $460 billion, with average interest rates gradually decreasing. Yet, after 2017, interest costs began to rise because of the nation’s increasing debt burden and shifts in market interest rates. In 2024, interest payements ballooned to $1.1 trillion, and by 2025, it has reached $921 billion.

Add Comment