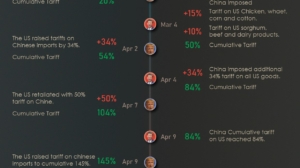

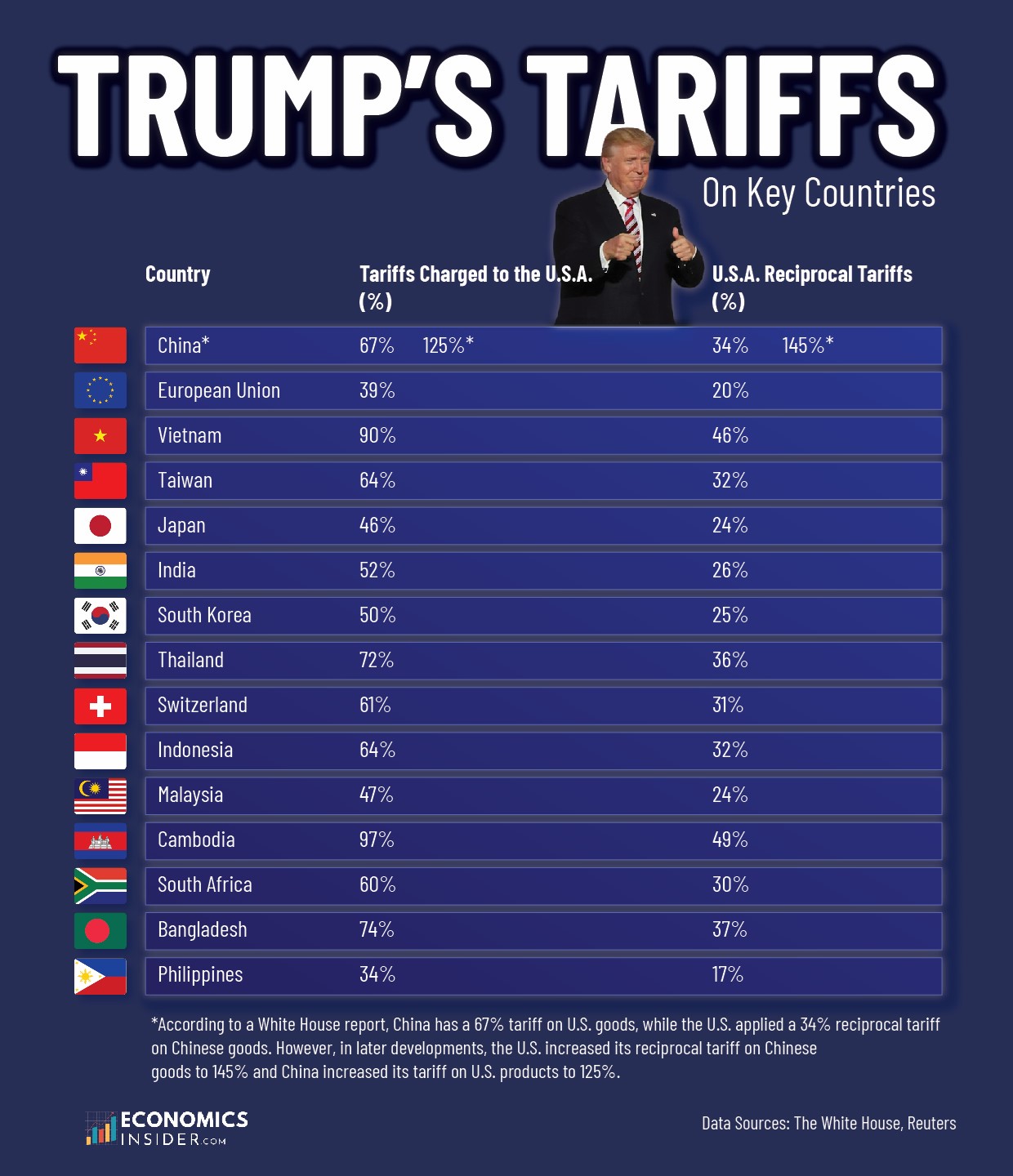

The Trump administration imposed reciprocal tariffs on a wide range of countries. While Trump pauses tariffs for most countries for 90 days, the tariffs on China remained in effect. The overall U.S. tariffs on Chinese goods have reached 145%, while China has imposed tariffs of 125% on American products.

According to a report published by the White House, in many cases, the United States applies significantly lower tariffs on its trading partners than what it receives in return. For example, countries like Vietnam and Cambodia impose much higher tariffs on U.S. goods, while enjoying relatively low tariffs on their exports to the United States.

Key Takeaways

- The U.S. tariffs on Chinese goods have reached 145%, in retaliation China has imposed tariffs of 125% on American products.

- Asian economies such as Cambodia, Vietnam, and Bangladesh show some of the largest tariff imbalances with the United states.

- A few nations, including the United Kingdom, Singapore, and Brazil, have near-equal reciprocal tariff rates with the U.S.

Trump’s Reciprocal Tariffs on Key Countries

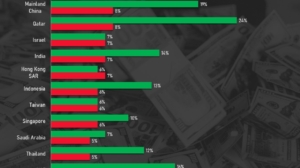

The following table shows the percentage of tariffs charged to U.S. goods by various countries, compared to the reciprocal tariffs on these countries by the US.

| Country | Tariffs Charged to the U.S.A. (%) | U.S.A. Reciprocal Tariffs (%) |

|---|---|---|

| 🇨🇳 China* | 67% (125%) | 34% (145%) |

| 🇪🇺 European Union | 39% | 20% |

| 🇻🇳 Vietnam | 90% | 46% |

| 🇹🇼 Taiwan | 64% | 32% |

| 🇯🇵 Japan | 46% | 24% |

| 🇮🇳 India | 52% | 26% |

| 🇰🇷 South Korea | 50% | 25% |

| 🇹🇭 Thailand | 72% | 36% |

| 🇨🇭 Switzerland | 61% | 31% |

| 🇮🇩 Indonesia | 64% | 32% |

| 🇲🇾 Malaysia | 47% | 24% |

| 🇰🇭 Cambodia | 97% | 49% |

| 🇿🇦 South Africa | 60% | 30% |

| 🇧🇩 Bangladesh | 74% | 37% |

| 🇵🇭 Philippines | 34% | 17% |

The data is sourced from the White House.

*According to a White House report, China has a 67% tariff on U.S. goods, while the U.S. applied a 34% reciprocal tariff on Chinese goods. However, in later developments, the U.S. increased its reciprocal tariff on Chinese goods to 145% and China increased its tariff on U.S. products to 125%.

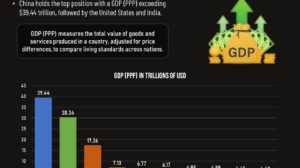

China

The United States and China are the two largest economies in the world. According to recent reports, the U.S. has imposed a 145% tariff on Chinese goods, with some sources indicating that this tariff has reached as high as 245% for some Chinese products. In response, China has imposed tariffs of 125% on U.S. products. While most of the tariffs introduced by the Trump administration were delayed for 90 days, those on China remain in effect.

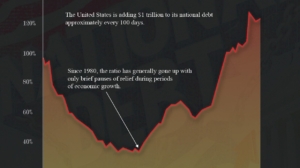

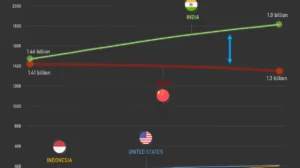

The recent U.S. tariff policy has once again sparked a trade war between the two countries. One key factor driving the high tariffs on China is the significant trade deficit the U.S. has with China. In 2024, the United States recorded its largest trade deficit with China, amounting to approximately $295 billion. Additionally, ongoing disputes over currency manipulation and market access have continued to strain the relationship between the two largest economies.

Vietnam

Vietnam is one of the major trading partners of the United States in Asia. According to the U.S Census Bureau, the United States recorded the third-largest trade deficit with Vietnam in 2024, which is equal to approximately $123 billion. The country charges a 90% tariff on American goods while paying only 46% when exporting to the U.S.

European Union

The EU imposes a 39% tariff on U.S. goods versus a 20% reciprocal tariff from the U.S. While these tariff rates are not as extreme as tariffs on China, this gap still shows that the U.S. grants more favorable access to European goods than it receives.

Additionally, Bangladesh imposes a 74% tariff on U.S. goods, compared to a 37% rate by the US on its exports. Like Vietnam, Bangladesh likely benefits from U.S. trade programs that aim to support emerging economies. Moreover, the United Kingdom, Singapore, and Brazil each charge a 10% tariff both ways, which indicates a more balanced trade relationship with the United States.

Impact of Trump’s Tariffs

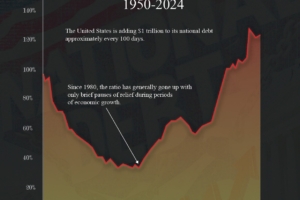

Due to Trump’s tariff policies, there is a growing fear of a US recession. Goldman Sachs recently increased the likelihood of a U.S. recession from 20% to 35%. Economists warned that these tariffs could do more harm than good, particularly to the U.S. economy.

Additionally, the higher tariffs may reduce global demand, raise costs for American businesses, and lead to higher prices for consumers. J.P. Morgan has already raised the probability of a global recession by the end of the year from 40% to 60%. It also predicts that the U.S. economy may face a mild recession, with GDP growth dropping by around 1.5% from 2%.

Conclusion

The tariffs and trade policies introduced by the United States may not only disrupt global supply chains but also place a burden on businesses and consumers, who often face higher costs as a result. These tariffs have already triggered a trade war with China, where both countries are imposing high tariffs on each other. The rising tensions in international trade can also slow down economic growth worldwide. In fact, JP Morgan has raised the probability of a global recession this year from 40% to 60%.

Add Comment