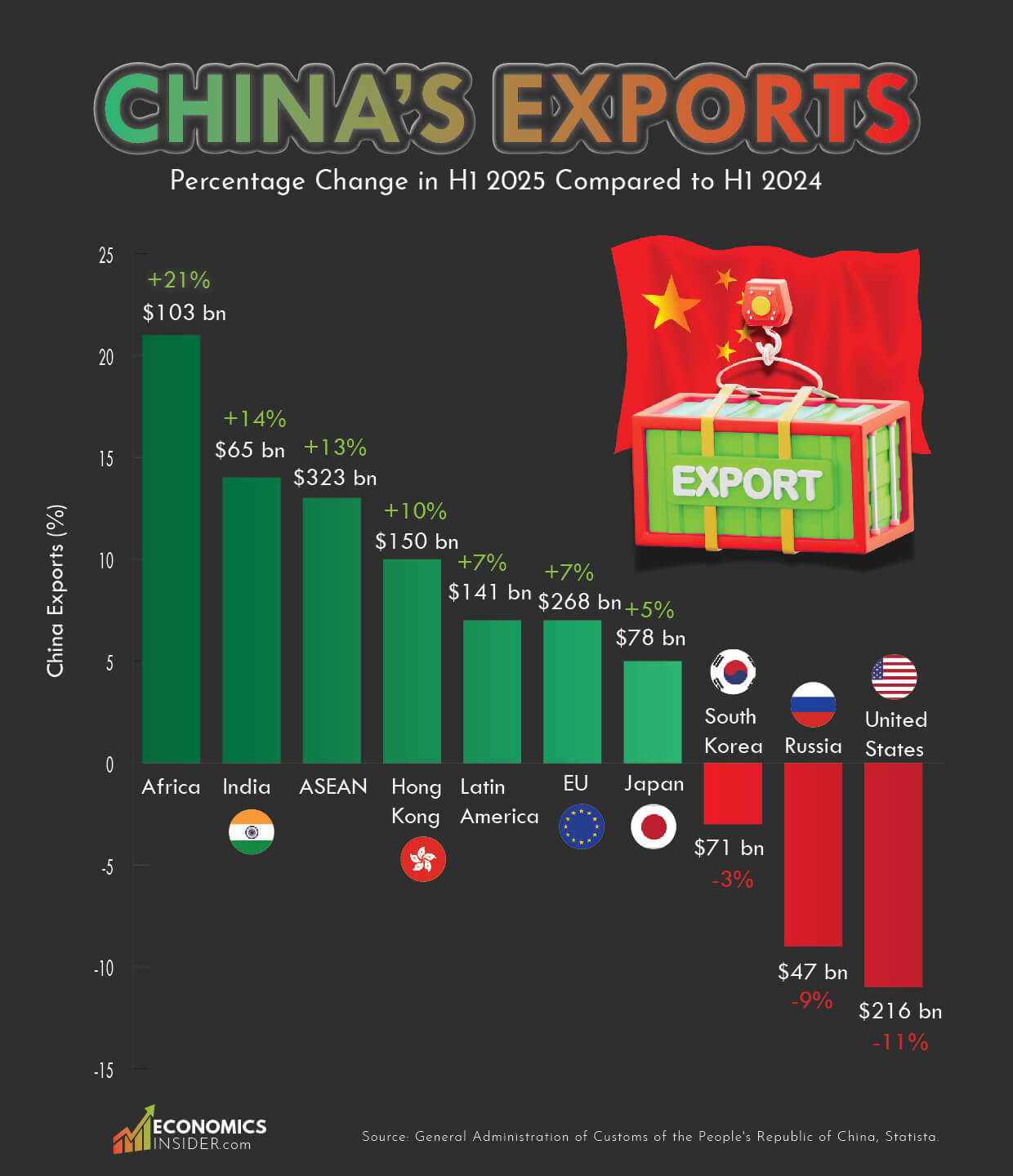

China’s trade is going through a major shift and it is working to reduce its reliance on the U.S. by turning to other regions. The country’s Exports to the United States are falling, while shipments to other countries are rising. The main reason is President Donald Trump’s new reciprocal tariffs on imports from dozens of countries.

According to Reuters, U.S. tariffs are putting heavy pressure on Chinese exporters. China sells over $400 billion worth of goods to the U.S. each year; however, many firms are now looking for safer options by expanding into nearby economies.

Key Takeaways

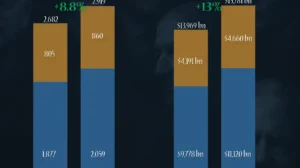

- The U.S. saw the biggest decline in Chinese exports, dropping 10.7% to $215.6 billion in the first half of 2025.

- Africa and India became the fastest-growing markets, with Chinese exports rising 21.4% to $103 billion.

- ASEAN countries are emerging as key trade partners, as exports to Southeast Asia jumped 13% to $323 billion, showing China’s shift toward nearby, fast-growing economies.

China’s Exports to the U.S. and Other Countries

The following table shows how China’s exports changed in the first half of 2025 compared to the same period in 2024:

| Region | Change from H1 2024 | Exports (Billion USD) |

|---|---|---|

| Africa | 21% | $103 |

| India | 14% | $65 |

| ASEAN | 13% | $323 |

| Hong Kong | 10% | $150 |

| Latin America | 7% | $141 |

| EU | 7% | $268 |

| Japan | 5% | $78 |

| S. Korea | -3% | $71 |

| Russia | -9% | $47 |

| U.S. | -11% | $216 |

Source: General Administration of Customs of the People’s Republic of China, Statista.

China’s Exports to the United States

The United States recorded the sharpest drop in Chinese exports, falling about 11% to $215.6 billion in the first half of 2025. Despite this decline, the U.S. remains one of China’s biggest trading partners, making up about 11 percent of its total exports. Additionally, The U.S. also runs one of the largest trade deficits with China, totaling $1.6 trillion over the five years from 2020 to 2024.

According to Reuters, many Chinese companies hurried to finish their orders earlier this year because of a short break in the tariff war. But now, with the chance of tariffs going above 100% again, selling to the U.S. has become less dependable. Even if China sells more to other regions, it will be difficult to fully replace the scale of U.S. demand.

Trump’s trade policies are pushing China to build firm trade relations with other countries and regions. Whether this shift lasts will depend on how high the tariffs are, how long they stay, and if China can keep growing in new markets to make up for falling exports to the United States.

China’s Exports to Africa and India

China’s exports grew the most in Africa, jumping 21% to $103 billion. India came next, with exports rising 14% to $65 billion. This shows how China is building new trade ties beyond its usual partners. Africa’s rising demand for infrastructure, along with India’s rising middle class, is creating new opportunities for China to sell more exports.

China’s Exports to ASEAN

China’s exports to ASEAN countries jumped 13% to $323 billion, making Southeast Asia one of the fastest-growing markets for Chinese goods. Reuters reported that exports to Southeast Asian transit hubs have been particularly strong, as Chinese firms look to these markets to offset weaker U.S. demand.

ASEAN countries are becoming central in China’s trade strategy because of their geographic closeness and growing economies. Nations such as Vietnam, Thailand, and Indonesia are becoming important trade partners for China.

China’s Exports to the European Union

China’s exports to the EU grew about 7% to $268 billion. Europe is still a steady trading partner for China, but its growth is slower than in Asia and Africa. The extra demand from Europe helps China soften the impact of falling U.S. sales, though the EU on its own can’t match the size of the American market.

Additionally, China’s exports to Latin America also rose approximately 7 percent to $141 billion. Hong Kong, often used as a re-export hub, saw exports rise 10 percent to $150 billion. Both regions demonstrate how China’s trade network is diversifying beyond the U.S.

Japan saw a modest increase of about 5 percent to $78 billion, while South Korea’s imports from China fell 2.5 percent to $71 billion. Russia recorded the steepest decline among non-U.S. partners, with exports down 8.7 percent to $47 billion.

Top 10 Countries the U.S. Had the Largest Trade Deficits in 2024

Conclusion

Trump’s new tariffs are clearly reshaping global trade flows. While China’s exports to the U.S. have fallen, the country is expanding trade ties with other regions like ASEAN, Africa, and India. According to Reuters, many Chinese firms are racing to capture market share in nearby economies to protect themselves from U.S. tariff risks.

However, even with these gains, it remains difficult for China to fully replace the American market. The U.S. still makes up almost 12% of China’s total exports, and losing such a large share would leave a big gap in China-U.S. trade.

Add Comment