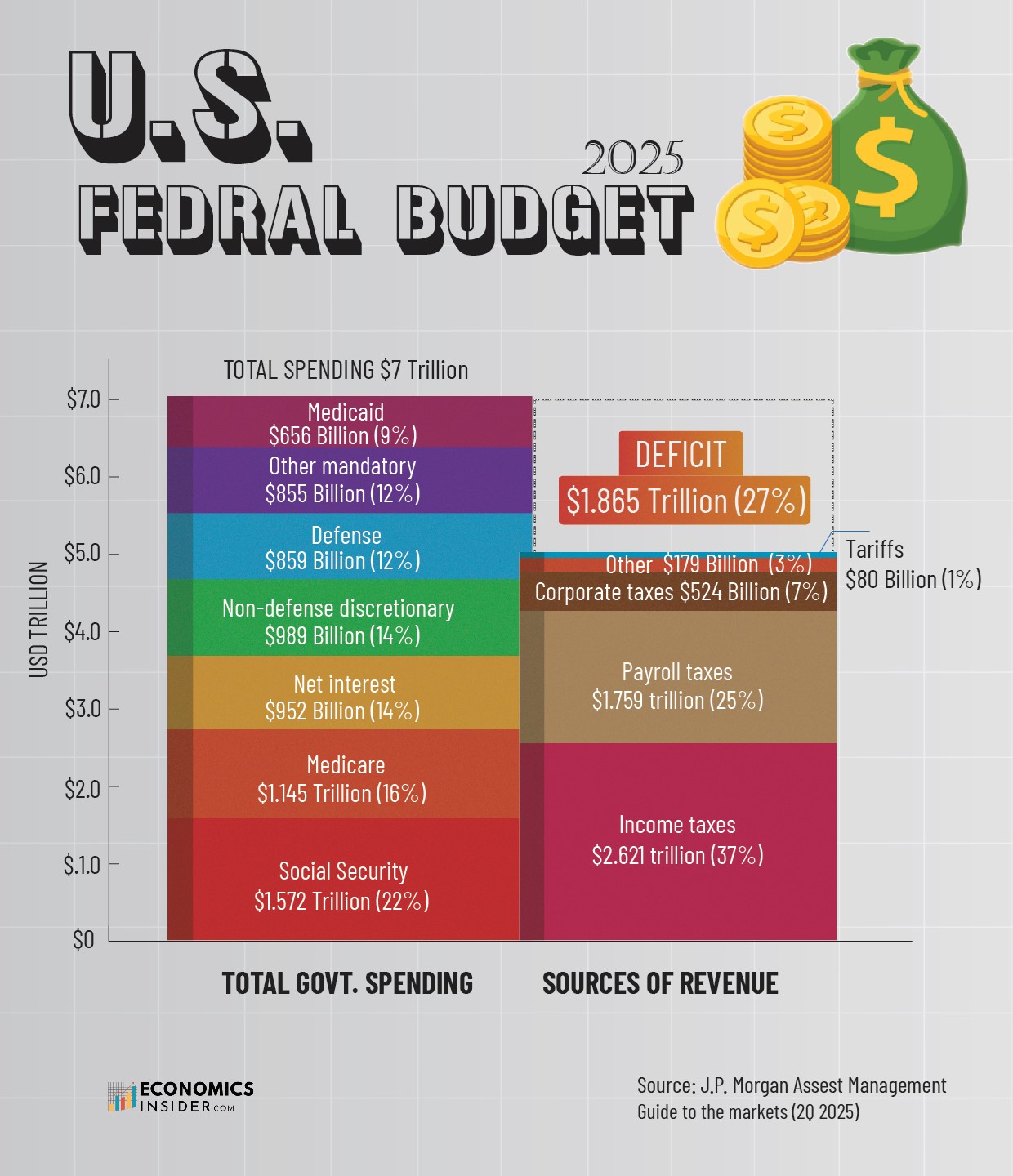

Every year, the U.S. government sets a budget to outline how much it plans to spend and where that money will come from. In the US federal budget 2025, the government plans to spend a total of $7 trillion—but it’s only bringing in $5.16 trillion in revenue. That leaves a deficit of approximately $1.8 trillion, meaning the government is spending significantly more than it’s earning. The last surplus for the federal government was in 2001. Since then, the US federal budget has remained in deficit, with the highest—$3.13 trillion—recorded in 2020.

U.S. spending continues to rise, especially on programs like Social Security and Medicare, while the money coming in from taxes hasn’t grown fast enough to keep up. Interest payments on the national debt are also becoming a bigger piece of the budget.

Key Takeaways

- In the US federal budget 2025, the U.S. government is spending more than it earns, resulting in a $1.8 trillion deficit.

- Since 2001, the US federal budget has remained in deficit, with the highest—$3.13 trillion—recorded in 2020.

- Social Security and Medicare take up a major portion of total spending with approximately $1.5 trillion and $1.1 trillion in spending, respectively.

- Interest payments on the national debt are rising fast, taking up nearly as much space in the budget as defense spending.

US Fedral Budget 2025

The following table shows how the federal government is dividing its $7 trillion budget across different areas of spending, and how it plans to raise revenue through taxes and other sources.

| Spending Breakdown | Amount (USD) | % of Total Spending | Revenue Breakdown | Amount (USD) | % of Total Revenue |

|---|---|---|---|---|---|

| Social Security | $1.572 trillion | 22% | Income taxes | $2.621 trillion | 51% |

| Medicare | $1.145 trillion | 16% | Payroll taxes | $1.759 trillion | 34% |

| Net interest | $0.952 trillion | 14% | Corporate taxes | $0.524 trillion | 10% |

| Non-defense discretionary | $0.989 trillion | 14% | Other | $0.179 trillion | 3% |

| Defense | $0.859 trillion | 12% | Tariffs | $0.080 trillion | 2% |

| Other mandatory | $0.855 trillion | 12% | |||

| Medicaid | $0.656 trillion | 9% | |||

| Total Spending | $7.000 trillion | 100% | Total Revenue | $5.163 trillion | 100% |

| Deficit | $1.8 trillion | 27% of Spending |

The data is sourced from the J.P. Morgan Assest Management | Guide to the Markets (2Q 2025).

The US federal budget 2025 shows that the U.S. government is focusing heavily on healthcare, retirement benefits, and defense. About three-quarters of all spending is going toward programs like Social Security, Medicare, Medicaid, and interest payments. On the revenue side, most of the money comes from income and payroll taxes, which are collected from individuals and workers. The data shows a clear gap between what’s being spent and what’s coming in.

1. U.S. Federal Government Spending Overview

Here is a breakdown of how the U.S. government spends its money and what are the largest spending categories.

Social Security – The Largest Slice of Spending

Social Security is the single largest category of spending in the US federal budget 2025. It accounts for $1.57 trillion, or 22% of total spending. This program provides monthly payments to retirees, people with disabilities, and some family members of deceased workers. The large amount going to Social Security reflects the reality of America’s aging population. As more people retire, the program requires more funding to keep up with payments.

Medicare and Medicaid

Medicare will cost $1.15 trillion, or 16% of total spending in the US federal budget 2025. Additionally, Medicaid will take up another $656 billion (9%). Together, these programs make healthcare accessible for seniors and low-income individuals. Rising healthcare costs and an aging population are the main reasons these numbers are so high.

Defense and Discretionary Spending

Defense spending sits at $859 billion, or 12% of total spending, and is used to fund military operations, salaries, and new technology. While defense has always been a major part of the federal budget, it’s now smaller than the combined cost of Medicare and Medicaid.

Non-defense discretionary spending, which includes funding for education, transportation, and public health, stands at $989 billion, or 14% of total spending. These are areas that often face cuts when deficits rise, even though they impact everyday life in the United States.

Net Interest

One of the most surprising parts of the US federal budget 2025 is how much is being spent just on interest payments. The U.S. has allocated a total of $952 billion, or 14% of total spending, towards interest payments. This is money that doesn’t go to any service or benefit but simply to pay off interest on the national debt. The U.S. debt has grown to approximately $36 trillion in 2025, and it continues to grow every day. As the debt grows and interest rates rise, this category is becoming one of the largest in the budget.

Top 10 Countries the U.S. Had the Largest Trade Deficits in 2024

2. U.S. Federal Government Revenue

The U.S. collects most revenue from taxes paid by individuals and workers. Income taxes bring in $2.62 trillion, while payroll taxes contribute $1.76 trillion to the total revenue pool. These two sources make up the majority of the US federal budget 2025 revenue.

Additionally, corporate taxes bring in a smaller portion—about $524 billion. Other sources, like tariffs and fees, make up the rest of the total revenue. In total, revenue for 2025 adds up to $5.16 trillion, which is not enough to cover all spending, leading to the $1.87 trillion deficit.

The Budget Deficit

When the government spends more than it earns, it borrows money to make up the difference. In the fiscal year 2025, the U.S. is projected to face an approximately $1.8 trillion budget deficit. That deficit money will need to be borrowed by selling U.S. Treasury securities and using other sources, adding to the national debt. The U.S. federal government recorded the last surplus budget in 2001.

Conclusion

In the US federal budget 2025, the government expects to spend $7 trillion, but it’s only bringing in $5.16 trillion in revenue. That means the U.S. will run a deficit of $1.87 trillion, which is the amount it has to borrow to cover the difference. Social Security is the largest spending category, followed by Medicare and Medicaid. Additionally, due to the growing U.S. debt, debt-related costs are rising fast—making interest payments one of the top expenditure categories in the entire budget.

Add Comment