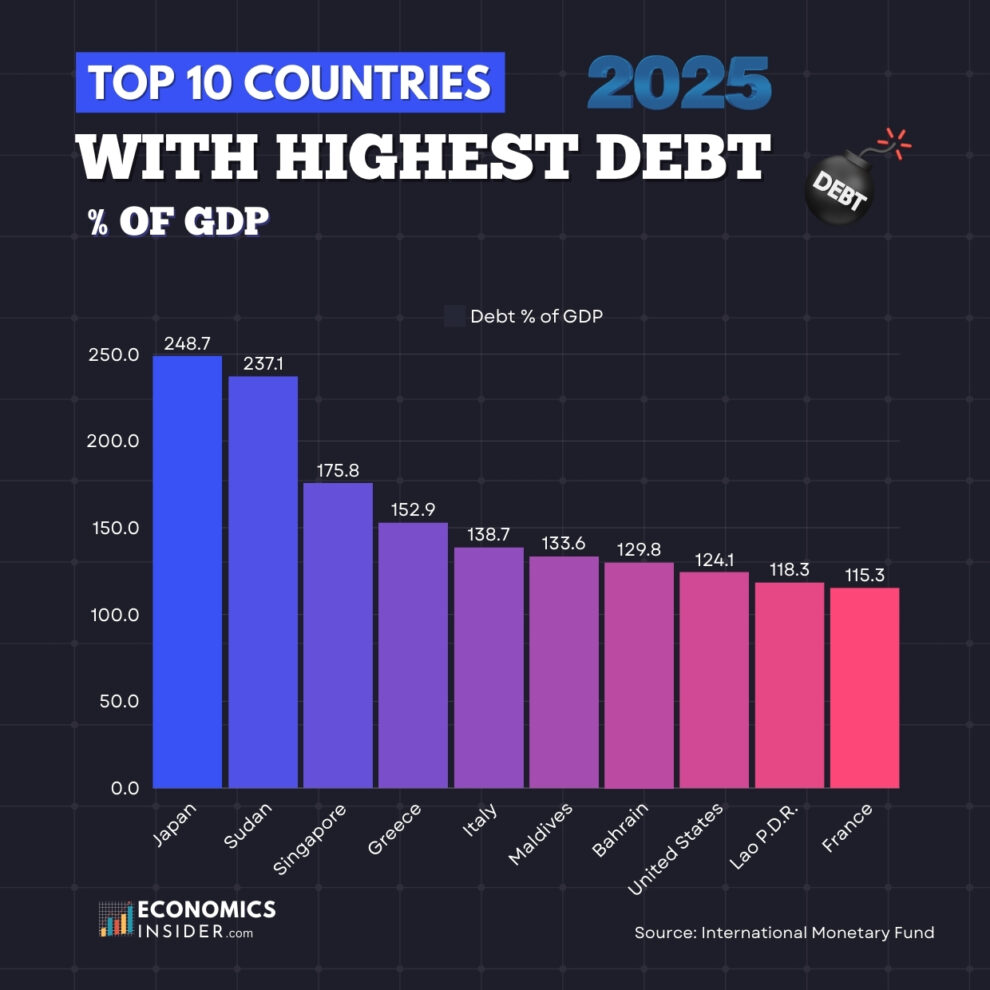

According to the IMF, global debt has surpassed a record level of over $100 trillion in 2025. The major addition in global debt is contributed by the world’s two largest economies, such as the United States and China. These two countries collectively owed $50 trillion in debt. The US has the largest debt of approximately $36 trillion, which is more than double that of China, about $16.5 trillion. Moreover, Japan has the highest debt-to-GDP ratio in the world, followed by Sudan and Singapore.

Countries With Highest Debt-to-GDP Ratios

The following table shows the top 10 countries with the highest debt-to-GDP ratio.

| Rank | Country | Debt % of GDP |

|---|---|---|

| 1 | Japan | 248.7 |

| 2 | Sudan | 237.1 |

| 3 | Singapore | 175.8 |

| 4 | Greece | 152.9 |

| 5 | Italy | 138.7 |

| 6 | Maldives | 133.6 |

| 7 | Bahrain | 129.8 |

| 8 | United States | 124.1 |

| 9 | Lao P.D.R. | 118.3 |

| 10 | France | 115.3 |

Data is sourced from the the International Monetary Fund.

Japan – 248% Debt-to-GDP Ratio

Japan’s debt-to-GDP ratio stands at 248%, the highest in the world and among developed nations. The country’s high debt-to-GDP ratio is caused by its persistent fiscal deficits, Covid-19 pandemic impacts and economic stagnation. Additionally, Japan’s aging population significantly increases the need for social security spending, which also contribute to the country’s burgeoning debt levels. Moreover, the period of economic stagnation known as the “Lost Decades,” combined with the impact of the Great Recession in 2008, has also contributed to Japan’s high debt-to-GDP ratio.

Despite having one of the highest debt-to-GDP ratios globally, Japan has the lowest default risk. This is because a large percentage of Japan’s debt is held domestically by the country’s population and institutions.

Interestingly, Japan has the highest debt-to-GDP ratio globally, but its absolute debt is not the highest in the world. The United States has the highest absolute debt globally, with a much smaller debt-to-GDP ratio than Japan.

Sudan – 237% Debt-to-GDP Ratio

Sudan has the second-highest debt-to-GDP ratio in the world, which stands at approximately 237%. The burgeoning debt in Sudan is contributed to by its prolonged internal conflicts, economic sanctions, and political instability. The loss of oil revenue following the secession of South Sudan in 2011 further increased the economic challenges and debt in Sudan. Additionally, the Sudanese pound has been depreciating and Interest on existing debt is rising. This has increased the cost of debt servicing and worsened the debt situation in the country.

Singapore – 175% Debt-to-GDP Ratio

Singapore has the third largest debt-to-GDP ratio in the world, which stands at about 175%. According to Statista, Singapore’s national debt has reached $953 billion and is expected to reach $1.2 trillion by 2029.

Despite having the third-highest debt-to-GDP ratio, Singapore has no net debt. This is because the government borrows primarily from itself by issuing bonds, which are then invested in its sovereign wealth funds. As a result, Singapore faces lowest default risk and little burden on its economy.

Greece – 152% Debt-to-GDP Ratio

Greece’s debt-to-GDP ratio has reached approximately 152%, the fourth largest in the world. The massive debt in Greece is the legacy of the financial crisis that began in 2009. The crisis led to severe austerity measures, economic contraction, and a significant increase in public debt. Additionally, persistent high government spending and excessive borrowing during a period of economic growth have led to the high debt levels in Greece. The country heavily relies on European Union and IMF bailout packages to stabilize its economy.

It is worth noting that Greece has indeed significantly reduced its debt-to-GDP ratio. According to IMF, By the end-2024, Greece’s public debt-to-GDP ratio is projected to have decreased by more than 50% from its peak in 2020.

Italy – 138% Debt-to-GDP Ratio

Italy’s debt-to-GDP ratio stands at approximately 138%. Despite being the third-largest economy in the Eurozone, Italy is persistently facing the high debt challenge. The country’s high debt level is attributed to factors such as stagnant economic growth, high public spending, and a large pension system.

United States – 124% Debt-to-GDP Ratio

The United States debt-to-GDP ratio stands at approximately 124% in 2025. The US debt-to-GDP ratio has steadily risen since 1980 and reached its highest during the COVID-19 pandemic. Although the US has a low debt-to-GDP ratio as compared to Japan (approximately 250%) and many other countries, it maintains the largest absolute national debt globally. The country’s debt has surpassed $36 trillion, which accounts for about a 35% share of global debt. Moreover, US debt is more than double that of China, about $16.5 trillion.

Maldives, Bahrain, Lao PDR, and France also have some of the highest debt-to-GDP ratios in the world. Their debt has exceeded 100% of their total GDP, which means that they owe more than the value of their entire GDP.

The Bottom 10 countries with the lowest debt-to-GDP ratio

The following table shows the bottom 10 countries with the lowest debt-to-GDP ratio.

| Rank | Country | Debt % of GDP |

|---|---|---|

| 1 | Macao SAR | 0 |

| 2 | Brunei Darussalam | 2.1 |

| 3 | Turkmenistan | 4.4 |

| 4 | Congo, Dem. Rep. of the | 6 |

| 5 | Tuvalu | 9.2 |

| 6 | Micronesia, Fed. States of | 10.6 |

| 7 | Hong Kong SAR | 11.3 |

| 8 | Haiti | 11.3 |

| 9 | Kuwait | 12.9 |

| 10 | Marshall Islands | 13.5 |

Source: International Monetary Fund

Conclusion

Debt can be a useful tool for countries with persistent fiscal deficit issues. However, the fast increase in public debt can be a heavy burden in the future. The debt servicing cost in many developing countries has surpassed the expenditures on education. According to the UNCTAD, rising global debt is creating more problems for developing countries. It states that over 50 developing countries globally spend more than 10% of their total revenues on debt servicing costs.

Add Comment