The U.S.’s top trading partners, Mexico, Canada, and China, account for over 40% of the total goods traded, which are worth more than $2 trillion. Trump implemented a 25% tariff on imports from Mexico and Canada, along with an additional 10% tariff on Chinese goods. However, Trump suspended his 25% tariffs on Mexico and Canada, but tariffs on China remained intact. The increased tariff on China could result in higher inflation rates in both the U.S. and China.

The Peterson Institute for International Economics analyzes that the imposition of tariffs by Trump on goods from Canada, Mexico, and China is estimated to result in losses of more than $1,200 for a typical American family per year. This cost is at the expense of the pricier daily consumer goods such as electronic devices, clothes, and household items.

Key Takeaways

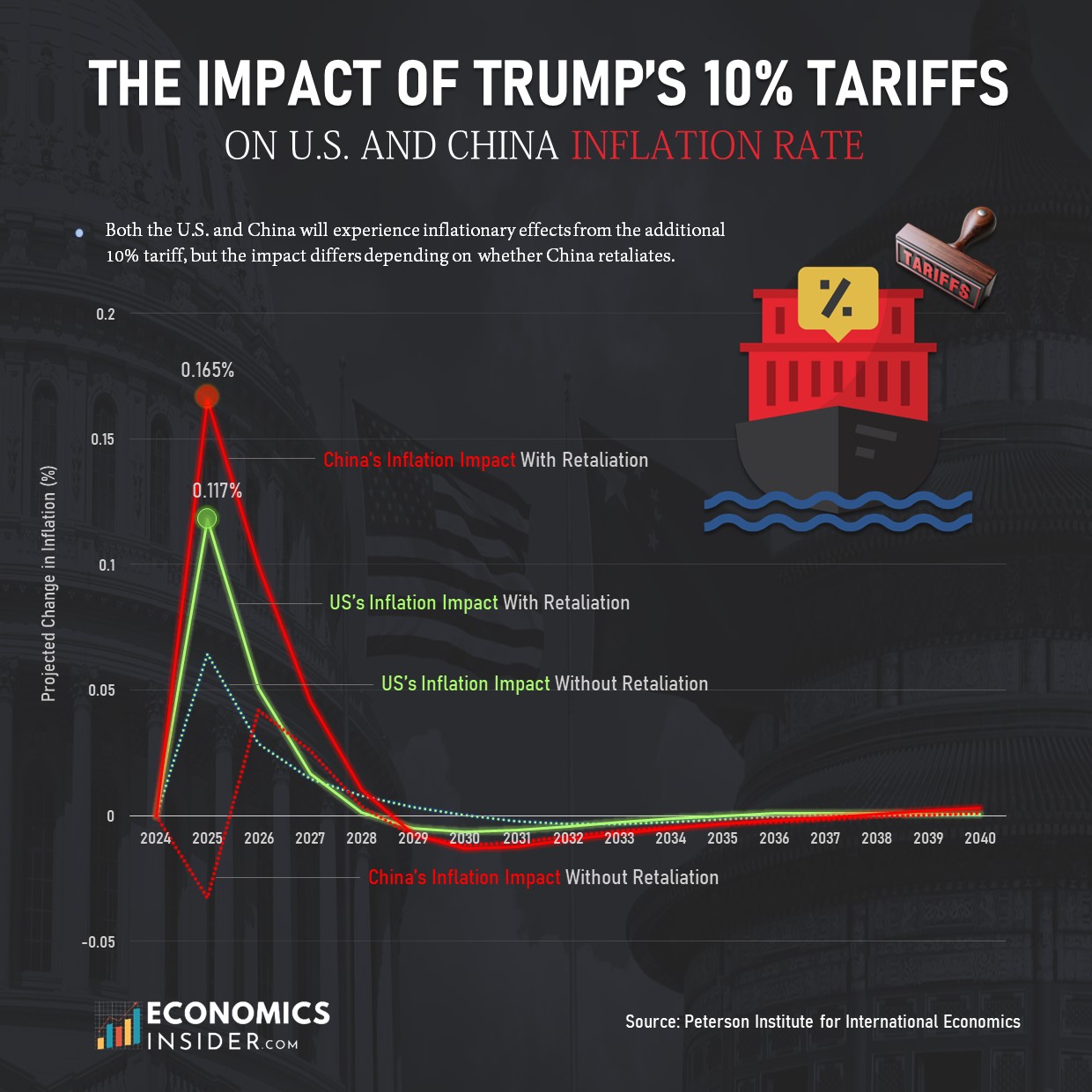

- If China does not retaliate, U.S. inflation rises slightly in 2025 before falling, while China sees a small dip and then stabilizes.

- If China retaliates, both countries face higher inflation, but China is hit harder and for a longer time.

- According to the Peterson Institute for International Economics, Trump’s tariffs on goods from Canada, Mexico, and China could cost the average American family over $1,200 per year.

Projected Impact of U.S. Tariffs on Inflation Rates

The table below shows the potential inflation rates in both the United States and China resulting from the U.S. tariff increases. It outlines the inflation impacts under two scenarios: with retaliation and without retaliation.

| Year | 🇺🇸 U.S. Inflation (%) | 🇺🇸 U.S. Retaliation Inflation (%) | 🇨🇳 China Inflation (%) | 🇨🇳 China Retaliation Inflation (%) |

|---|---|---|---|---|

| 2024 | 0 | 0 | 0 | 0 |

| 2025 | 0.0645 | 0.117946 | -0.032736 | 0.165421 |

| 2026 | 0.028735 | 0.050591 | 0.042036 | 0.099469 |

| 2027 | 0.014573 | 0.016812 | 0.025875 | 0.045649 |

| 2028 | 0.007929 | 0.001285 | 0.003864 | 0.010265 |

| 2029 | 0.003551 | -0.004841 | -0.008309 | -0.007563 |

| 2030 | 0.00013 | -0.0064 | -0.011789 | -0.013157 |

| 2031 | -0.002265 | -0.005856 | -0.01073 | -0.012456 |

| 2032 | -0.003419 | -0.004419 | -0.008321 | -0.009698 |

| 2033 | -0.003415 | -0.002723 | -0.006127 | -0.006996 |

| 2034 | -0.002628 | -0.001151 | -0.004536 | -0.004939 |

| 2035 | -0.001537 | 0.000056 | -0.003386 | -0.003381 |

| 2036 | -0.000547 | 0.00079 | -0.002417 | -0.00202 |

| 2037 | 0.000114 | 0.001068 | -0.001471 | -0.000676 |

| 2038 | 0.000401 | 0.001002 | -0.000534 | 0.000662 |

| 2039 | 0.000389 | 0.000744 | 0.000328 | 0.001895 |

| 2040 | 0.00021 | 0.000437 | 0.001027 | 0.002908 |

The data is sourced from the Peterson Institute for International Economics.

These figures imply an initial high inflation rate for both the U.S. and China. However, the U.S. is expected to experience a more pronounced increase in inflation, especially under retaliatory scenarios.

Long-Term Inflation Forecasts For Both Nations

The data suggests that both the U.S. and China will experience inflationary effects from the additional 10% tariff, but the impact differs depending on whether China retaliates.

In the non-retaliation scenario, U.S. inflation initially rises, peaking at 0.0645% in 2025, before gradually decreasing in later years. China’s inflation, on the other hand, sees a slight dip in 2025 at -0.0327%, but then stabilizes with minor fluctuations.

However, in the retaliation scenario, the inflationary impact is worse for both countries. U.S. inflation nearly doubles in 2025 to 0.1179%, while China experiences a sharper increase, reaching 0.1654% in the same year. This suggests that China’s retaliatory tariffs will lead to higher consumer prices within its own economy, likely due to increased costs of imported raw materials and goods from the U.S. Over time, inflation in both nations declines, but China continues to see a more prolonged impact compared to the U.S.

This analysis shows that, although both countries will feel inflationary pressures, China is likely to be hit harder in the short term, particularly under a retaliation scenario. Additionally, the data highlights that Chinese inflation jumps upward more sharply and also lasts longer than in the U.S. It suggests that retaliation could worsen economic conditions in China more than in the U.S. However, American consumers and businesses will still feel the pinch, especially in industries reliant on Chinese imports.

How a 10% Tariff on China Could Hurt Both the U.S. and Chinese Economies

U.S.-China Trade War

The U.S. and China have been engaged in a trade war since 2018, when the Trump administration imposed tariffs on Chinese products. Following Trump, the Biden administration also imposed tariffs on China to address its trade deficit with China. In response, China retaliated with tariffs on several U.S. products, such as soybeans and pork, thus contributing to the higher prices for the businesses and consumers of the two countries. Additionally, some tariffs imposed in 2018 are still in effect; Trump further imposed new tariffs on Chinese imports in his second term, which resulted in escalating the trade war between the two nations.

Conclusion

Summing up, the proposed 10% tariff increase between the U.S. and China is expected to be a huge blow to both nations. The potential result for the American consumers is that they might face a hike in the prices of electronics, clothes, and household items. Similarly, Chinese consumers may face higher prices for imported agricultural products and luxury goods from the U.S. At the same time, businesses in both countries may see their production costs go up, which in the end would mean higher prices for consumers.

Add Comment