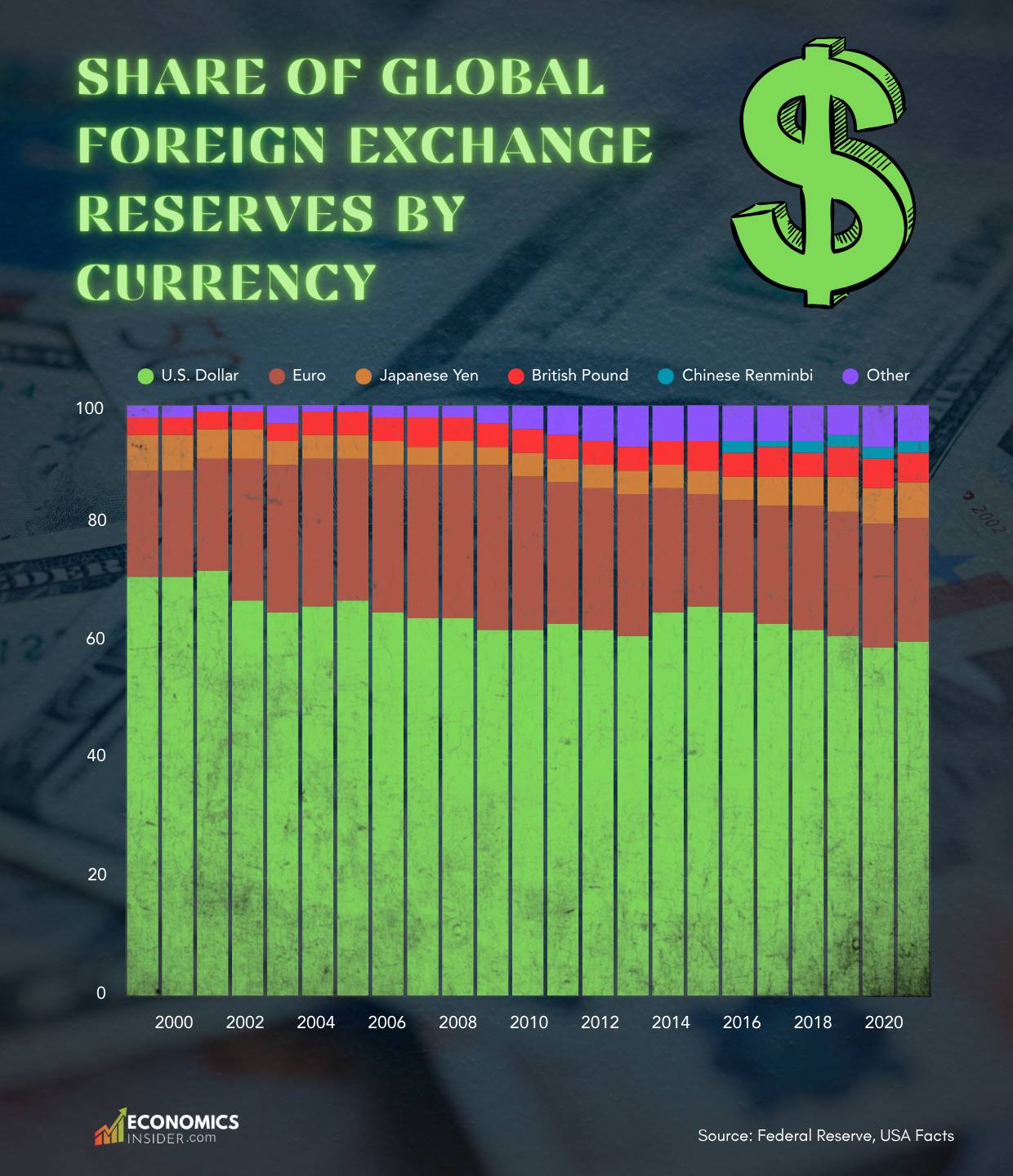

For more than seventy years, the U.S. dollar has been the most powerful currency in the world. In the last twenty years, however, the world started to change. According to the IMF, in 1999, about 71% of all foreign exchange reserves held by central banks were in U.S. dollars. That number dropped to 59% as of 2021. In other words, countries are gradually keeping a smaller share of their money in dollars and diversifying into other currencies, including the euro, the Japanese yen, the British pound, and more recently, the Chinese yuan, or renminbi.

This gradual shift doesn’t mean the dollar is collapsing soon. The dollar remains the dominant currency in global finance. Yet the steady decline shows that the global financial system is balancing out and that countries are seeking to avoid dependence on a single currency.

Key Takeaways

- The U.S. dollar still holds the largest share of global reserves, but its dominance has been slowly shrinking.

- The euro remains the second most used reserve currency but hasn’t grown much in recent years.

- The small but fast-rising yuan of China shows how economic power is gradually shifting from the West to the East.

Share of Global Foreign Exchange Reserves by Currency

This table shows how the use of major currencies in global foreign exchange reserves has changed from 1999 to 2021. It shows that the U.S. dollar has stayed the most used currency, while other currencies like the euro, yen, and Chinese renminbi have slowly become more common.

| Year | U.S. Dollar | Euro | Japanese Yen | British Pound | Chinese Renminbi | Other |

|---|---|---|---|---|---|---|

| 1999 | 71 | 17.9 | 6.4 | 2.9 | NA | 1.8 |

| 2000 | 71.1 | 18.3 | 6.1 | 2.8 | NA | 1.8 |

| 2001 | 71.5 | 19.2 | 5 | 2.7 | NA | 1.6 |

| 2002 | 66.5 | 23.7 | 4.9 | 2.9 | NA | 2 |

| 2003 | 65.4 | 25 | 4.4 | 2.9 | NA | 2.2 |

| 2004 | 65.5 | 24.7 | 4.3 | 3.5 | NA | 2 |

| 2005 | 66.5 | 23.9 | 4 | 3.7 | NA | 1.9 |

| 2006 | 65 | 25 | 3.5 | 4.5 | NA | 2 |

| 2007 | 63.9 | 26.1 | 3.2 | 4.8 | NA | 2 |

| 2008 | 63.8 | 26.2 | 3.5 | 4.2 | NA | 2.3 |

| 2009 | 62.2 | 27.7 | 2.9 | 4.3 | NA | 3 |

| 2010 | 62.2 | 25.8 | 3.7 | 3.9 | NA | 4.4 |

| 2011 | 62.7 | 24.4 | 3.6 | 3.8 | NA | 5.4 |

| 2012 | 61.5 | 24.1 | 4.1 | 4 | NA | 6.3 |

| 2013 | 61.3 | 24.2 | 3.8 | 4 | NA | 6.7 |

| 2014 | 65.2 | 21.2 | 3.5 | 3.7 | NA | 6.4 |

| 2015 | 65.7 | 19.1 | 3.8 | 4.7 | NA | 6.6 |

| 2016 | 65.4 | 19.1 | 4 | 4.3 | 1.1 | 6.1 |

| 2017 | 62.7 | 20.2 | 4.9 | 4.5 | 1.2 | 6.4 |

| 2018 | 61.7 | 20.7 | 5.2 | 4.4 | 1.9 | 6.1 |

| 2019 | 60.7 | 20.6 | 5.9 | 4.6 | 1.9 | 6.2 |

| 2020 | 58.9 | 21.3 | 6 | 4.7 | 2.3 | 6.7 |

| 2021 | 59.5 | 20.6 | 5.9 | 4.7 | 2.4 | 6.8 |

Source: Federal Reserve, USA Facts

The Rise of the Dollar As Reserve Currency

To understand the current status of US dollar, one needs to go back to how it became the world’s number one currency in the first place.

Following World War II, the world’s economy was in shambles. Many countries had lost confidence in their currencies, and trade between nations had virtually collapsed. In 1944, world leaders met at the Bretton Woods Conference in the U.S. to construct a new global financial system.

Under this system, the U.S. dollar was pegged to gold, and all other currencies were pegged to the dollar. One ounce of gold was worth $35, and the United States promised to exchange dollars for gold whenever other countries asked. Since America had most of the world’s gold reserves and the strongest economy at that time, countries began to trust the dollar as good as gold.

The trust laid the bedrock of the dollar’s current global power. Around the world, central banks began to hold U.S. dollars as their leading reserve asset. International trade, oil, and global finance started using the dollar for payments.

The world, however, kept using it even after 1971 when President Richard Nixon stopped the dollar’s direct link to gold. But by then, it had already gained deep roots in international trade and finance.

Why the Dollar Stayed on Top for So Long

The United States has the world’s largest and most liquid financial markets. Any country can easily purchase or sell U.S. Treasury bonds (government debt), which are considered one of the safest investments in the world. This keeps the dollar useful and reliable by means of liquidity. The U.S. also has one of the largest and most stable economies in the world.

Additionally, because so many countries already use the dollar, it keeps getting stronger. Oil, gold, and other global commodities are priced in dollars. Most international loans and trade deals are done in dollars. It creates a cycle-the more people use the dollar, the more valuable and trusted it becomes.

Other Major Currencies: The Euro, Yen, and Pound

When the euro came into being in 1999, many economists assumed that it would eventually rival the dollar’s dominance. And for a while, at least, it seemed to. Its share of global reserves rose from around 18% in 1999 to over 25% in the late 2000s.

But then came the European debt crisis, 2009–2012, when countries like Greece, Spain, and Italy struggled with heavy debts. That crisis reduced trust in the euro and showed that Europe wasn’t fully united when it came to financial issues. Since then, the euro’s share has stayed around 20%.

The Japanese yen and British pound hold smaller but relatively stable shares of foreign exchange reserves. The yen typically represents 5–6% of international reserves. Japan has a stable economy, but its sluggish growth has prevented the yen from appreciating further. The British pound, which had the largest share in the world during the time of the British Empire, currently constitutes about 4–5% of international reserves. Although their shares are small, these currencies help to balance global reserves and give options other than the dollar.

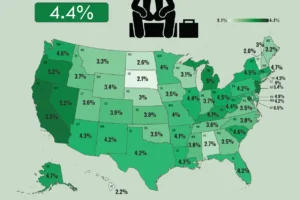

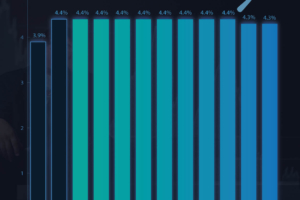

Top Countries With the Largest Foreign Exchange Reserves

The Rise of the Chinese Yuan (Renminbi)

But perhaps the most interesting change in recent years is the rise of the Chinese yuan — or RMB. Twenty years ago, the yuan had almost no presence in global reserves, whereas by 2021 it accounted for roughly 2.4% — a small share that was growing fast.

China’s influence in global trade is enormous. The country is the world’s largest exporter and the second biggest economy after that of the United States. To decrease dependence on the dollar, China has been encouraging countries to use the yuan in trades and investment.

In projects like the Belt and Road Initiative, China provides loans in its currency to developing countries. This promotes the spread of its use. In 2016, the IMF officially added the yuan to its basket of reserve currencies-known as Special Drawing Rights (SDR) as a recognition of its importance as a global currency.

Despite the still-limited role of the yuan in global trade and finance, the currency’s rise reflects how the balance of financial power is shifting toward Asia.

The Slow Decline of the U.S. Dollar’s Share

While the dollar stays strong, its share of global reserves has been declining. From about 71% in 1999 to 59% in 2021, the decline indicates a gradual shift by countries toward more diversified holdings.

There are various reasons for this decline. Political tensions, global trade wars, and financial sanctions have made some countries wary of overdependence on the dollar system. For instance, when the U.S. imposed sanctions on Russia, it froze Russian dollar assets, an act that once again reminded other countries of how the U.S. could directly influence the international financial system.

Large holders meanwhile have been trying to diversify their assets: they purchase more gold, euros, and yuans. This trend doesn’t mean the dollar is about to lose its dominance; it just means the world is balancing out and becoming less dependent on one currency.

The Rise of BRICS and Alternative Systems

The BRICS group — consisting of Brazil, Russia, India, China, and South Africa — has been among the most insistent voices for a new financial order. These are fast-growing countries which do not want to depend solely on the U.S. dollar both for their trade and reserves.

In recent years, BRICS+ members have spoken of introducing their own currency for international trade or using their national currencies instead of the dollar. For instance, Russia and China now settle much of their trade in rubles and yuan. Several countries in Asia, Africa, and Latin America are also signing agreements to use local currencies when trading with China.

The Chinese government has introduced an alternative to the SWIFT system, called the Cross-Border Interbank Payment System to protect it from dependence on Western-dominated financial networks. This system allows countries to send and receive payments without going through U.S. banks.

These efforts are small compared with the dollar’s reach, but they illustrate how hard the world is trying to reduce dependence on one country’s financial system.

Conclusion

The U.S. dollar isn’t going away anytime soon. It’s still the most trusted, most used, and most stable currency in the world. About 60% of global reserves and over 80% of international trade transactions are still in dollars.

But the long-term trend points toward diversification. Technology will also play a significant role in shaping the future. Digital currencies, central bank digital money, or CBDCs, and blockchain-based payment systems would hence make it easier for countries to trade without needing the dollar as a middleman.