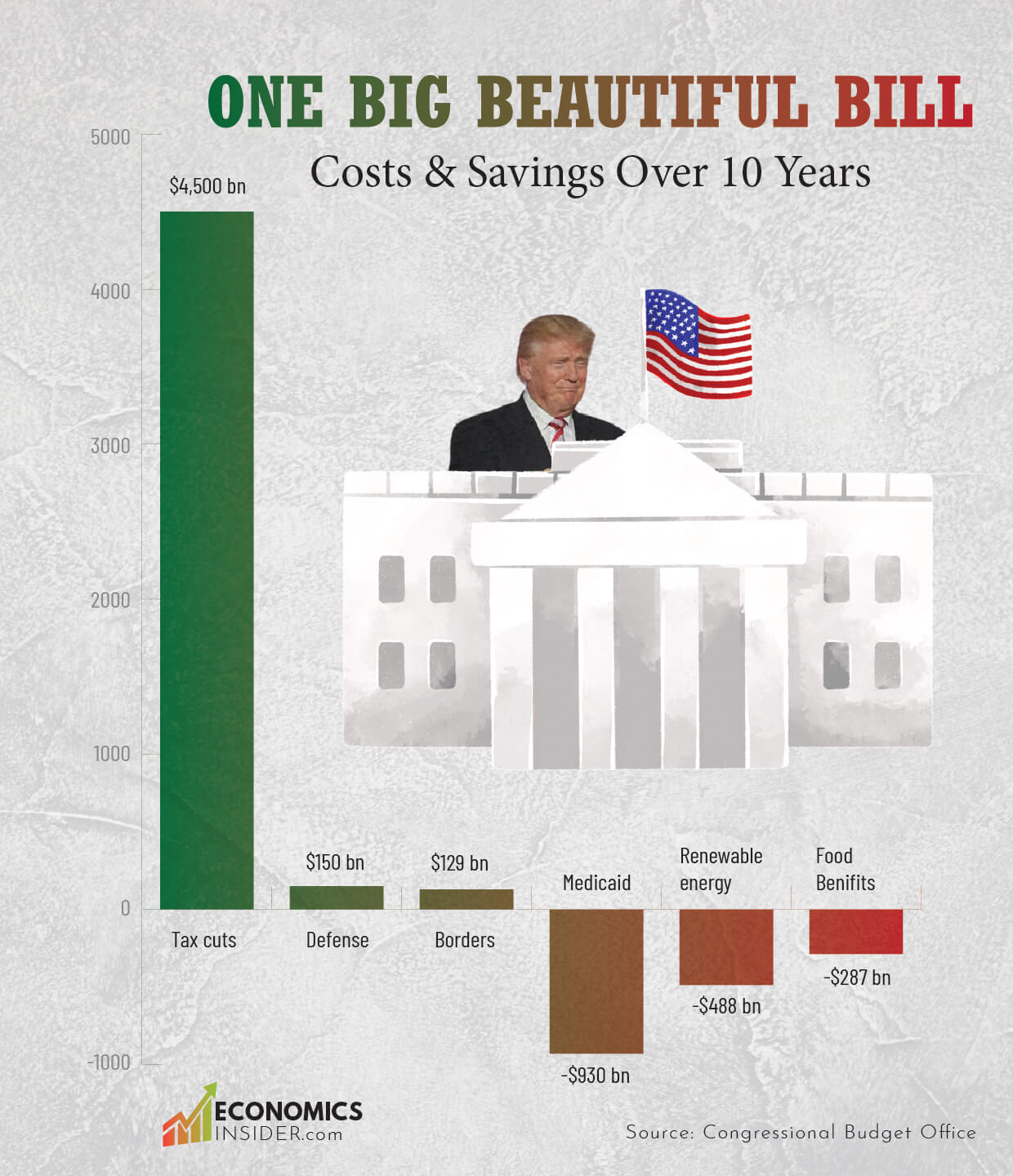

President Donald Trump’s ‘One Big Beautiful Bill Act’ lays out the United States’ fiscal path for the next decade. It extends Trump’s 2017 tax cut policy and is set to reduce taxes by $4.5 trillion over the next decade. The bulk of these enormous tax breaks benefiting large corporations and high-income individuals.

The bill further includes steep cuts in social safety net programs such as Medicaid and food stamps. Based on estimates from the Congressional Budget Office (CBO), the bill will increase the federal debt by more than $3 trillion over a decade.

Key Takeaways

- The One Big Beautiful Bill Act continues Trump’s 2017 tax cuts and intends to slash taxes by $4.5 trillion in the next decade.

- Medicaid will be hit with the largest funding reduction of $930 billion over 10 years, which will leave millions of Americans uninsured.

- Renewable energy programs, such as wind and solar, will be trimmed by almost $500 billion.

Breakdown of the Data

The following table indicates the projected 10-year increases and decreases in federal expenditures and savings based on estimates from the Congressional Budget Office. The numbers indicate costs and savings through different policy areas affected by the Big Beautiful Bill.

| Category | Amount | Type |

|---|---|---|

| Medicaid | -$930bn | Savings |

| Renewable energy | -$488bn | Savings |

| Food benefits | -$287bn | Savings |

| Borders | $129bn | Spending |

| Defence | $150bn | Spending |

| Tax cuts | $4,500bn | Spending |

The data is sourced from the Congressional Budget Office.

Tax Cuts: $4.5 Trillion in Reductions

The most important section of the bill is a colossal tax cut proposal valued at $4.5 trillion over the decade. The tax cuts mainly favor corporations, top earners, and large corporations, and are an extension of Trump’s tax policy of 2017. The administration claims that the tax cut will prompt investment and job growth in the corporate sector.

However, critics say the reductions disproportionately benefit the wealthy and will worsen income inequality. The tax cuts will lead to larger government deficits for years and add approximately $3 trillion to the national debt, according to estimates by the CBO.

Medicaid Cuts: $930 Billion Reduction

Medicaid, the health insurance program for low-income and disabled Americans, will be slashed by $930 billion over the 10 years. The CBO predicts that 12 to 17 million people could lose coverage due to these changes.

The most controversial elements is the new rule requiring able-bodied adults with children over 15 to work or volunteer at least 80 hours a month to retain coverage. The Medicaid cuts in the bill could seriously hurt vulnerable groups like older adults, people with disabilities, and low-income families.

Renewable Energy Cuts: $488 Billion

The bill cuts $488 billion from renewable energy programs. Most of these cuts come from ending tax credits that were introduced during the Biden administration to support wind and solar projects.

These changes show that the US federal government moving away from supporting clean energy and climate efforts. Additionally, Because of the cuts, there will likely be less investment in clean energy and slower progress toward reducing carbon emissions.

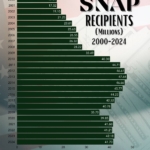

Food Benefits (SNAP): $287 Billion in Reductions

The Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, faces a cut of $287 billion. This is part of a bigger plan to reduce government assistance for low-income people. As a result, an estimated 4.7 million current SNAP recipients could lose their benefits between 2025 and 2034.

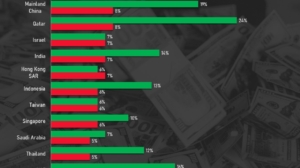

Top 15 Largest US Treasury Holders in 2025: Who Owns America’s Debt?

Defense Spending: $150 Billion Boost

While cutting Medicaid and other social programs, the bill plans to increase defense spending by $150 billion. A large part of this money will go toward building more Navy ships and starting Trump’s “Golden Dome” missile defense system.

The U.S. is already the largest defense spender in the world. In 2024, America spent nearly $1 trillion on defense or 3.8% of its GDP which is more than any other country.

Border Security: $129 Billion Boost

Following Trump’s immigration plans, the bill sets aside $129 billion for border and immigration enforcement. Most of this money will go to Immigration and Customs Enforcement (ICE), allowing the agency to almost double its detention space for migrants and hire many more staff.

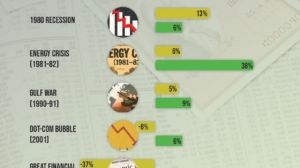

How the “One Big Beautiful Bill Act” Impacts U.S. National Debt

The US debt is already approaching $37 trillion in 2025, which is more than 120% of the country’s GDP. The large tax cuts in the bill will deepen the fiscal deficit over the years, leading to increased borrowing to cover the gap. According to the Congressional Budget Office, the bill will add more than $3 trillion to the US national debt over the next decade.

At the start of 2025, the U.S. hit its debt ceiling of $36.1 trillion, however, the One Big Beautiful Bill raised the debt ceiling by $5 trillion, bringing it to $41.1 trillion. Since 1960, Congress has raised, or changed the debt ceiling 78 times, showing how often the government has had to adjust its borrowing limit.

During his first term, Trump added about $8 trillion to the national debt. This increase in the debt was mostly because of the 2017 tax cuts and the emergency spending during the COVID-19 pandemic.

Conclusion

The One Big Beautiful Bill is one of the most important budget laws in recent U.S. history. It makes big changes in US fiscal policy over the next decade. The bill is cutting support for healthcare, food, and clean energy, and putting more money into tax cuts, defense, and immigration enforcement.

Add Comment