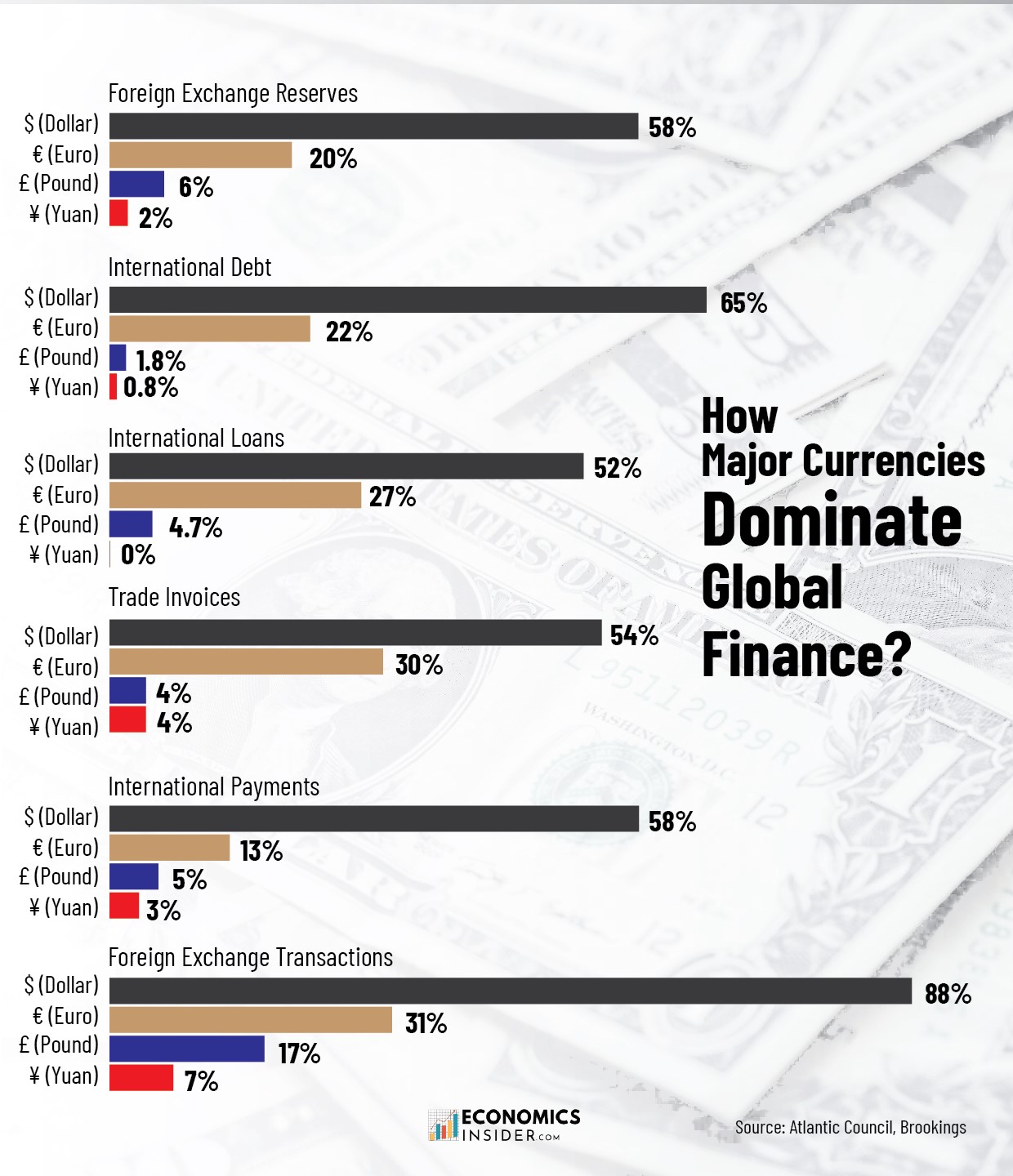

The U.S. dollar has been the world’s most powerful currency for a long time. It holds the top position across many important areas of global finance, including exchange reserves, international debt, trade bills, and currency trades. In all these areas, the dollar is utilized more than any other currency, indicating its leadership position in the global financial system. According to the Atlantic Council, the U.S. dollar makes up 88% of all foreign exchange transactions globally. It also represents over 65% of international debt and about 58% of global payments.

Though the U.S. dollar remains the most dominant currency, other currencies are gradually growing their influence in international finance. This article examines major currencies such as the U.S. dollar, euro, British pound, and Chinese yuan (renminbi) and their share in the global financial system.

Key Takeaways

- The U.S. dollar dominates all major global financial categories, from reserves to trade invoicing.

- The euro and pound remain strong second-tier currencies, especially in international loans and payments.

- The Chinese yuan is growing but still lags far behind the dollar in all global financial metrics.

Global Currency Use in Key Financial Areas

The following table shows how major currencies like the U.S. dollar, euro, pound, and Chinese yuan are used across six global financial categories, including reserves, debt, and payments etc.

| Category | US Dollar ($) | Euro (€) | British Pound (£) | Chinese Yuan (CN¥) |

|---|---|---|---|---|

| Foreign Exchange Reserves | 58% | 20% | 6% | 2% |

| International Debt | 65.50% | 22% | 1.80% | 0.80% |

| International Loans | 52% | 27.60% | 4.70% | 0% |

| Trade Invoices | 54% | 30% | 4% | 4% |

| International Payments | 58.07% | 13.19% | 5.36% | 3.23% |

| Foreign Exchange Transactions | 88% | 31% | 17% | 7% |

The data is sourced from the Atlantic Council and Brookings.

The US dollar dominance is evident from the fact that it is used more than any other currency in global finance. In each financial category, it holds the largest share globally.

1. The U.S. Dollar: Global Dominant Currency

The dollar’s dominance is not surprising. It is the world’s most trusted and liquid currency. In foreign exchange transactions, it has a stunning 88% share. This means nearly every currency trade involves the dollar in some way. It also makes up over 65% of international debt and is the leading currency for foreign exchange reserves.

One reason that makes the US dollar the dominant currency is trust. The U.S. has the largest and most stable economy in the world. Its financial markets are deep and transparent, and the dollar is easy to trade and widely accepted. As a result, many central banks and global companies prefer using the dollar in their transactions.

The impact of US dollar dominance on global financial system is significant. Countries that rely on the dollar for trade and debt are influenced by U.S. interest rates and financial policies. When the Federal Reserve raises rates, it can affect economies around the world.

2. The Euro

The euro is the second most used currency in global finance. It plays a major role in Europe and in many global financial deals. It makes up 20% of foreign exchange reserves and 27.6% of international loans. It’s also used in 30% of trade invoices and over 13% of international payments.

The euro’s strength comes from the size and importance of the European Union. As a major trading bloc, Europe uses the euro for a large share of its internal and external economic activity. Many countries also use the euro as a reserve currency because of the EU’s economic stability.

The British Pound

Despite Brexit and changing global dynamics, the pound retains its appeal in international markets. It continues to hold a respectable place in international finance. In international finance, it represents 6% of foreign exchange reserves and plays a role in nearly 17% of currency trades. Though its global role is smaller than the dollar or euro, it still matters—especially in banking and investment sectors.

Additionally, the UK’s long history as a financial center, especially in London, helps the pound maintain influence. London remains a top destination for currency trading, lending, and financial services globally.

G20 Growth Rates: Which Economies Are Leading?

The Chinese Yuan

The Chinese yuan, or renminbi (CN¥), is growing in importance but still lags far behind major currencies such as the dollar, euro, and pound. It makes up just 2% of foreign exchange reserves and less than 1% of international debt. In payments, it holds a 3.23% share, and in currency trades, its share is about 7%.

China has made a big push to internationalize its currency, including creating agreements for yuan-based trade and launching the Cross-Border Interbank Payment System (CIPS). Additionally, as one of the world’s largest exporters, China is actively promoting the use of its currency by encouraging direct currency swaps and supporting cross-border payments. It is also developing alternative payment systems to reduce its dependence on the U.S. dollar in global trade and move toward a more multipolar financial system.

The yuan’s increasing use in trade invoices (4%) and foreign exchange transactions shows China’s growing role in the global economy. However, China’s capital controls, lack of full currency convertibility, and concerns about transparency limit the yuan’s wider use and its ability to seriously challenge U.S. dollar dominance.

Threats to Dollar Dominance

Even though the dollar is still the world’s top currency, a few key trends have been challanging its position. The BRICS group has been discussing the idea of creating a shared currency to reduce their dependence on the dollar in trade. At the same time, countries like Russia and China are making more efforts to use their own currencies in international trade. These steps are part of a wider move toward de-dollarization, especially in response to sanctions and political tensions with the United States.

Another threat to US dollar dominance is the growing use of cryptocurrencies like Bitcoin, along with the development of digital currencies by central banks, particularly in China. While these changes won’t replace the dollar anytime soon, they may slowly reduce its dominance in global finance.

Conclusion

In all major categories including reserves, debt, loans, trade, payments, and currency trading, the U.S. dollar leads by a wide margin. The euro and pound continue to serve as important secondary currencies, and the Chinese yuan is slowly growing its global role.

However, the dominant role of the dollar is being chipped away in small but meaningful ways. The rise of cryptocurrencies and the de-dollarization efforts by BRICS countries, along with China’s push to use its own currency in trade, are creating new challenges to U.S. dollar dominance.

Add Comment