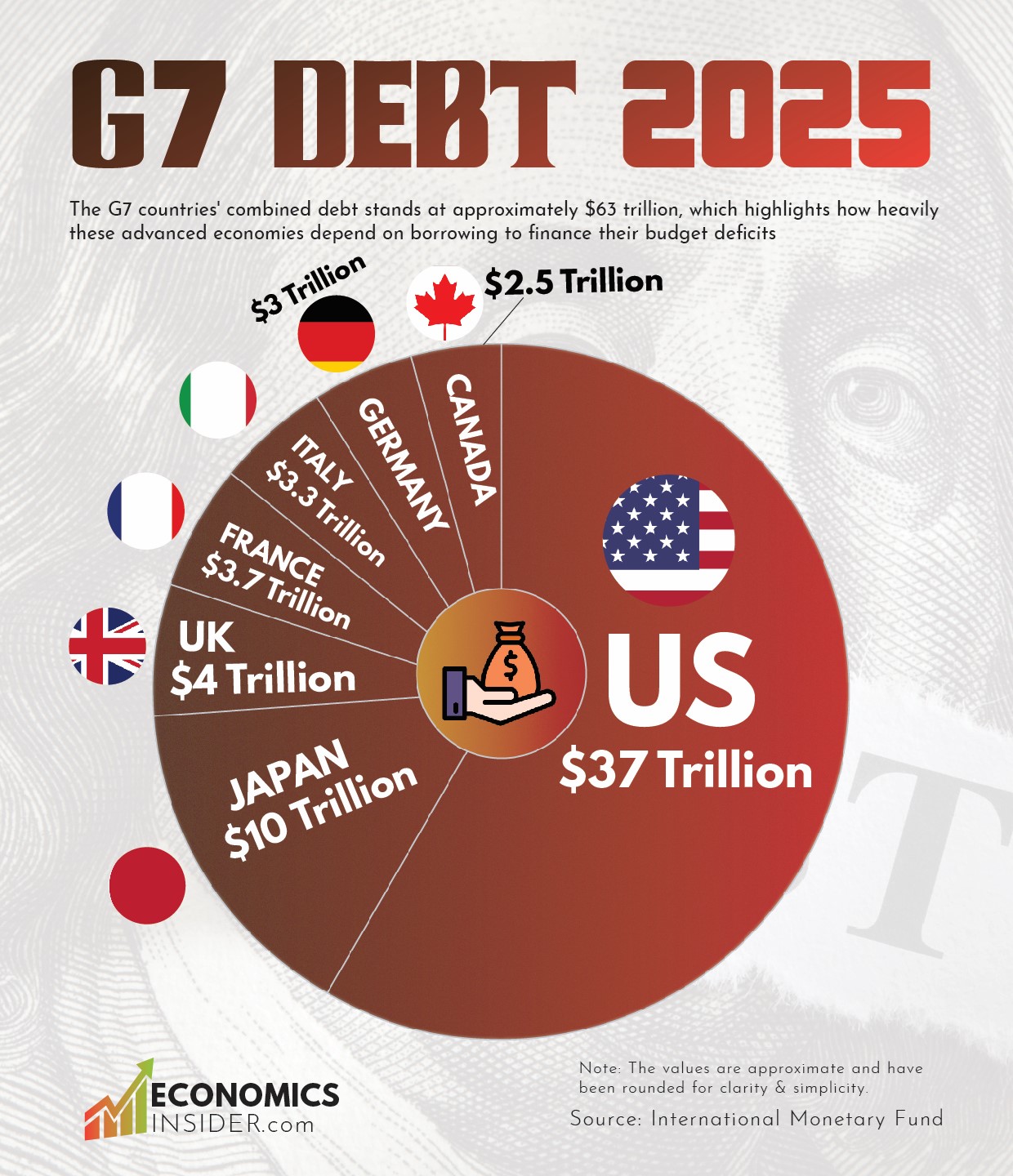

Some of the biggest and most advanced G7 economies face the worst debt crises. The United States, which has the biggest economy in the world, also has the highest total debt. The U.S. total debt stands at approximately $37 trillion, which is much higher than the combined debt of the other G7 nations of approximately $26 trillion. Japan boasts the biggest debt-to-GDP ratio among G7 economies at 234%. While Canada has the lowest absolute debt among the G7 at $2.5 trillion.

A high debt to GDP ratio does not necessarily mean a nation is in crisis. Factors such as who holds the debt, how much interest is being paid, the rate of economic growth, and the confidence in the government all play key roles in determining the debt situation of a country. Nations such as Japan can sustain high debt without significant issues.

Key Takeaways

- The United States’ debt is so enormous that it is larger than the total debt of the other six G7 countries combined.

- Canada has the lowest absolute debt among the G7 nations at $2.50 trillion.

- G7 countries’ collective debt totals about $63 trillion, which indicates how much these developed economies are relying on borrowing to finance their deficits.

G7 Debt Data

The table below shows the debt-to-GDP ratio, size of GDP, and size of debt of G7 economies.

| Country | Debt to GDP (%) | GDP (2025, $ Trillion) | Debt (2025, $ Trillion) |

|---|---|---|---|

| 🇺🇸 United States | 122% | $30.51 trillion | $37.22 trillion |

| 🇯🇵 Japan | 234% | $4.19 trillion | $9.81 trillion |

| 🇬🇧 United Kingdom | 103% | $3.84 trillion | $3.96 trillion |

| 🇫🇷 France | 116% | $3.21 trillion | $3.72 trillion |

| 🇮🇹 Italy | 137% | $2.42 trillion | $3.32 trillion |

| 🇩🇪 Germany | 65% | $4.74 trillion | $3.08 trillion |

| 🇨🇦 Canada | 112% | $2.23 trillion | $2.50 trillion |

The Debt-to-GDP ratios and GDP figures are sourced from the International Monetary Fund. The debt values have been estimated by the author using this data.

🇺🇸 United States

The United States boasts a debt-to-GDP ratio of 122% and a debt of approximately $37 trillion. This enormous debt in absolute value is because of the enormous size of the U.S. economy, which is about $30 trillion. The US debt is equivalent to about $106,000 for each individual in America. Even more concerning, the debt is increasing by about $1 trillion every 100 days.

One of the leading reasons for the increasing US national debt is the chronic budget deficit. The United States has had yearly budget deficits for most of the 20th and 21st centuries. The second most significant reason for the increasing U.S. national debt is the aging population in the country. With more individuals aging, they qualify for Social Security and Medicare programs, which increase spending and borrowing.

Further, this excessive debt is a result of decades of government expenditure on defense, social welfare, infrastructure, and interest on previous debt. In times of emergencies such as the COVID-19 pandemic or economic slowdown, America borrows even more to cushion its economy. Despite the high debt, investors still have confidence in U.S. government treasury securities. Japan is the largest holder of the US treasury bills above $1 trillion, followed by the United Kingdom and then China.

U.S. Debt to GDP Ratio: How America’s National Debt Reached $36 Trillion

🇯🇵 Japan

Japan has the highest debt-to-GDP ratio of 234% among the G7 nations. Its combined debt is approximately $10 trillion, which is more than double Japan’s GDP of approximately $4 trillion. The nation’s high debt level is primarily fueled by its aging population and high social expenditure.

Japan spends a big chunk of its budget on pensions, medical care, and other welfare schemes in order to take care of its aging population. In order to fund these services, the government borrows money rather than increasing taxes.

The majority of Japan’s debt is held domestically, i.e., by Japanese citizens and institutions instead of foreign investors. This prevents Japan from becoming a default or subject to external pressure.

🇬🇧 United Kingdom

The United Kingdom has a debt-to-GDP ratio of 103%, with total debt around $3.96 trillion. The UK’s debt rose in recent years because of economic challenges like Brexit, the COVID-19 pandemic, and inflation pressures.

The UK government is a big spender on healthcare, social programs, and economic support packages. Although this kept businesses and individuals afloat during difficult times, it also increased debt levels. Investors tend to be confident in the UK’s financial system due to London’s position as one of the world’s strongest financial centers.

🇫🇷 France

France’s debt as a percentage of GDP is 116% and its total debt is approximately $3.7 trillion. France, like most European nations, spends a lot of money on public services like healthcare, education, and social welfare programs. This strong social safety net is costly and forces the government to allocate more money instead of reducing services.

🇮🇹 Italy

Italy’s debt-to-GDP stands at 137%, which is among the highest in Europe. Italy has a total debt of approximately $3.3 trillion, while its GDP stands at approximately $2.4 trillion.

Italy faces long-standing issues such as slow economic growth, high unemployment, and political instability. These are factors that hinder Italy from decreasing its debt. Additionally, the country is devoting much of its budget to paying interest, leaving it with less money for public services or investments.

🇩🇪 Germany

Germany’s debt to GDP ratio is 65% with a total debt of approximately $3 trillion. Germany is Europe’s biggest economy with a GDP of about $4.7 trillion in 2025. It also has the lowest debt-to-GDP ratio of 65% among G7 nations, which is manageable, according to economists.

Germany’s government usually runs budget surpluses or has minimal deficits. During crisis periods such as the COVID-19 pandemic, Germany raised expenditure to stimulate the economy but maintained debt levels lower than most other G7 countries.

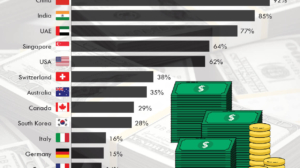

Top Countries With the Highest Number of Billion-Dollar Companies in 2025

🇨🇦 Canada

Canada boasts the lowest absolute debt of $2.5 trillion among G7 nations. Its debt-to-GDP ratio is 112%. Canada’s debt rose in recent years due to pandemic-related expenditure and measures to stimulate the economy. Although its debt to GDP ratio is higher than Germany’s, it is lower than that of Japan, Italy, and France.

Conclusion

Advanced economies rely most on debt to fund their social welfare programs and maintain their economies. The United States has the highest absolute debt in the world, Japan has the highest debt-to-GDP ratio compared to its economy. Germany, with its careful fiscal policy has the lowest debt to GDP ratio. Other G7 nations, such as Italy and France, still continue to spend on their generous social welfare programs and rely heavily on borrowing to maintain these services.

Add Comment