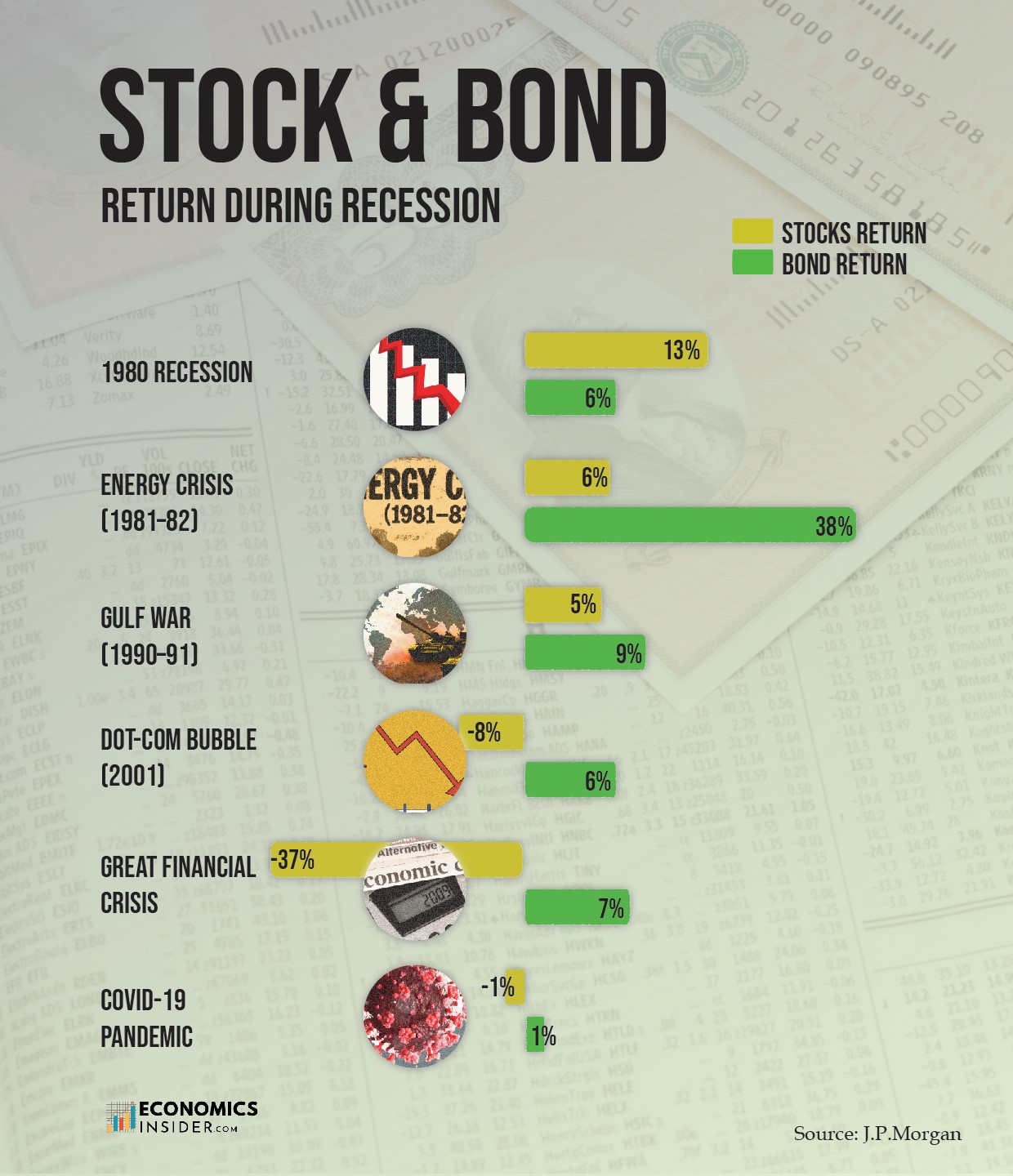

Recent data from J.P. Morgan Asset Management provides valuable insights into how stocks and bonds have performed during some of the worst recessions over the past four decades. The data shows that bonds usually perform better than stocks during recessions. Whereas stocks can plummet severely when the economy is in recession, bonds generally remain stable or even increase. This is why bonds are a good means of hedging a portfolio when times get tough.

Key Takeaways

- In six past U.S. recession, bonds gave positive returns, even when stocks went down. This shows that bonds are usually safer during recession.

- Stock performance during recessions has been mixed. Sometimes they rise, but in deeper recessions like 2008 and 2001, they dropped a lot more than bonds.

What Are Stocks and Bonds?

Stocks and bonds are two common types of investments. When you buy a stock, you’re buying a small portion of the company. If the company performs well, the stock’s value may increase. However, if the company underperforms, your stock will decrease in value.

Conversely, bonds are similar to loans you provide to a government or company. In return, they vow to repay you later with some additional money known as interest.

Stocks can grow more over time but are riskier, while bonds are usually safer but offer smaller returns.

How Stocks and Bonds Performed During Recessions

The following table shows the returns for stocks and bonds in the US during six key recessions events.

| Recession Period | Stocks Return (%) | Bonds Return (%) |

|---|---|---|

| 1980 Recession | 13% | 6% |

| Energy Crisis (1981–82) | 6% | 38% |

| Gulf War (1990–91) | 5% | 9% |

| Dot-com Bubble (2001) | -8% | 6% |

| Great Financial Crisis | -37% | 7% |

| COVID-19 Pandemic | -1% | 1% |

The data is sourced from the J.P. Morgan Asset Management.

The numbers show that the return on bonds was positive in every single recession. In contrast, stocks had both gains and losses. Most importantly, when stocks dropped a lot, as during the Great Financial Crisis (–37%) and the Dot-com Bubble (–8%), bonds still managed to grow (7% and 6% returns, respectively).

Even in smaller or shorter recessions like the Gulf War and the COVID-19 Pandemic, bonds still performed better than stocks.

Why Bonds Often Do Better in Recessions

Bonds have a better performance during times of recession due to a variety of reasons. First, when markets are volatile and unstable, investors like to invest in safer places. In this situation, government and high-quality corporate bonds are seen as more stable investments. Therefore, this shift in investors’ demand helps push bond prices up, leading to positive returns even when the overall economy is in a weak position.

Another key reason is how central banks respond during a recession. In a recessionary phase, interest rates are usually cut to help support the economy. Since bond prices move in the opposite direction of interest rates, therefore, falling rates often lead to rising bond prices. This makes bonds more attractive during periods of economic stress.

Additionally, bonds are less risky compared to stocks. They are less volatile and their yields tend to be more predictable. This predictability makes them a safer investment when stocks are undergoing significant declines.

U.S. vs. China: GDP Output Comparison from 2014 to 2025

The Major Trend in the Data

Looking across all six recessions, bonds consistently provided positive returns, regardless of how deep or mild the recession was. On the other hand, stocks were more unpredictable. Sometimes they gained, like in the 1980 Recession or the Energy Crisis. But more often, especially in deeper recessions like 2008 or 2001, stocks lost a lot of value.

What stands out most is that in every recession where stocks fell sharply, bonds still posted gains. However, the 1980 Recession is a good example of how not all recessions are the same. In that period, stocks actually returned 13%, while bonds earned 6%. But that was unusual. In most cases, especially during more serious recessions, bonds were clearly the safer and more rewarding choice.

Conclusion

There is no perfect crystal ball when it comes to investing. The past recessions show that bonds are more stable and give reliable returns during downturns, while stocks are more volatile and risky. This shows the strength of having a balanced investment portfolio. While one part of your investments may go down, another part can help cushion the blow.

Add Comment