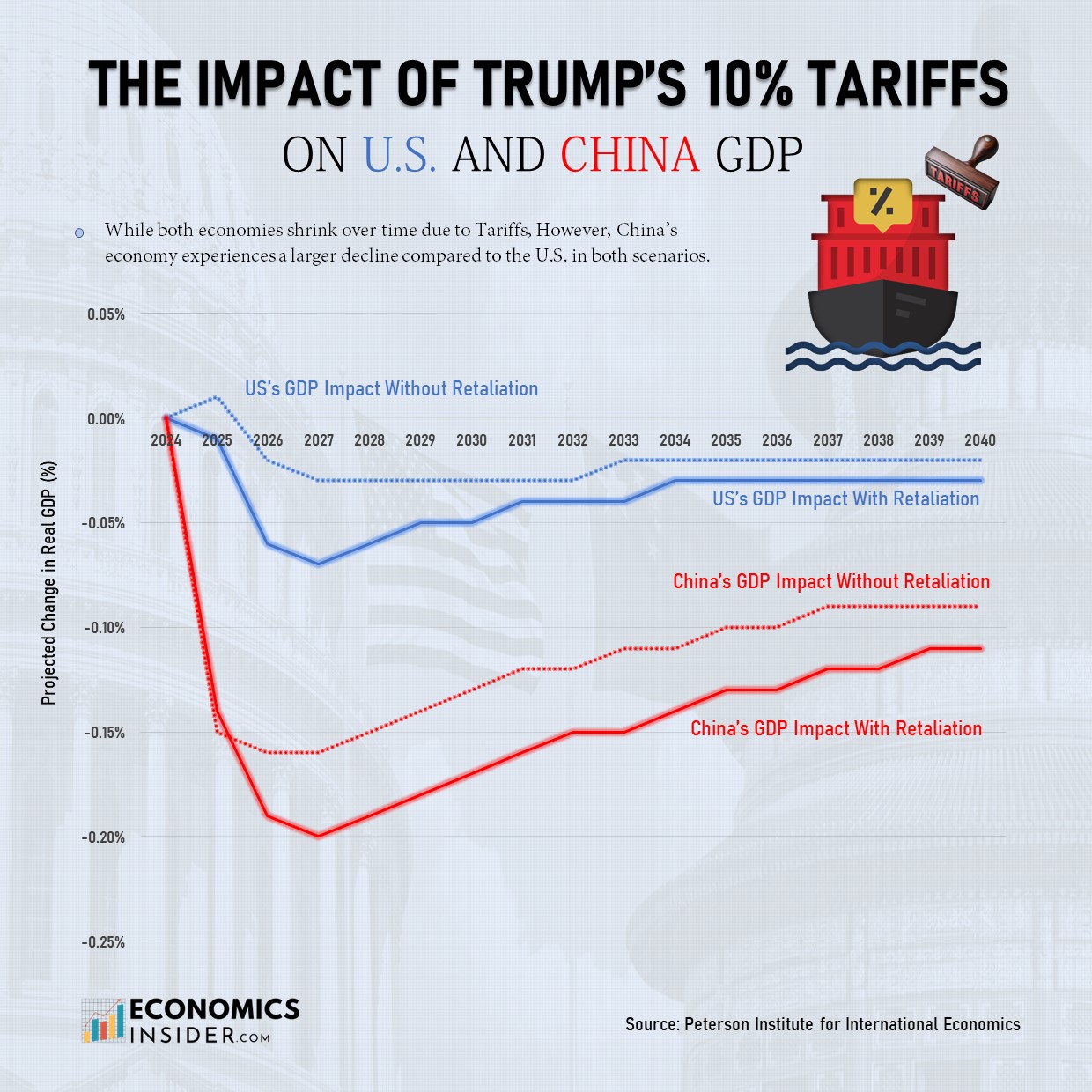

President Trump has implemented a 25% tariff on all goods from Canada and Mexico, along with an additional 10% tariff on Chinese goods. He has temporarily suspended the 25% tariff threat on Canada and Mexico for 30 days. However, the 10% tariff on Chinese goods remains in place. If the United States imposes an additional 10% tariff on Chinese imports, China would most likely retaliate with its own tariffs on American goods. Such a tit-for-tat trade war would be harmful to both economies. How would a new 10% tariff on Chinese goods impact both the U.S. and China?

The Peterson Institute for International Economics projects that the U.S. economy could decline by $55 billion over four years, and inflation would rise by 0.2%, making everyday goods slightly more expensive. The worst scenario for the U.S. would be if the new tariffs were also placed on Mexico and Canada as well. China, on the other hand, would feel an even more devastating impact: $128 billion in four years. Inflation in China would increase by 0.3%, but prices might temporarily drop as China adjusts its currency.

Key Takeaways

- Trump’s additional 10% tariff on Chinese goods could harm both the U.S. and Chinese economies.

- Without retaliation, U.S. tariffs have a small impact on the U.S. economy but cause a bigger decline in China’s GDP.

- If China retaliates, both economies suffer more, but China still experiences a greater economic downturn than the U.S.

Projected Impact of 10% Additional Tariffs on China

The table below shows the potential impact of U.S. tariffs on both the U.S. and China’s real GDP growth over the next two decades.

| Year | 🇺🇸 US Real GDP Change | 🇺🇸 US Real GDP Change – with retaliation | 🇨🇳 China Real GDP Change | 🇨🇳 China Real GDP Change – with retaliation |

|---|---|---|---|---|

| 2024 | 0.00% | 0.00% | 0.00% | 0.00% |

| 2025 | 0.01% | -0.01% | -0.15% | -0.14% |

| 2026 | -0.02% | -0.06% | -0.16% | -0.19% |

| 2027 | -0.03% | -0.07% | -0.16% | -0.20% |

| 2028 | -0.03% | -0.06% | -0.15% | -0.19% |

| 2029 | -0.03% | -0.05% | -0.14% | -0.18% |

| 2030 | -0.03% | -0.05% | -0.13% | -0.17% |

| 2031 | -0.03% | -0.04% | -0.12% | -0.16% |

| 2032 | -0.03% | -0.04% | -0.12% | -0.15% |

| 2033 | -0.02% | -0.04% | -0.11% | -0.15% |

| 2034 | -0.02% | -0.03% | -0.11% | -0.14% |

| 2035 | -0.02% | -0.03% | -0.10% | -0.13% |

| 2036 | -0.02% | -0.03% | -0.10% | -0.13% |

| 2037 | -0.02% | -0.03% | -0.09% | -0.12% |

| 2038 | -0.02% | -0.03% | -0.09% | -0.12% |

| 2039 | -0.02% | -0.03% | -0.09% | -0.11% |

| 2040 | -0.02% | -0.03% | -0.09% | -0.11% |

The data is sourced from the Peterson Institute for International Economics.

What Does the Long-Term Forecast Say?

In the scenario without retaliation, the U.S. economy experiences minimal changes. In 2025, it saw a minimal 0.01% increase, and by 2026, it started to decline to -0.02 percent annually. Additionally, the US GDP growth rate is projected to decline only a little to 0.03% annually from 2027 to 2032 and then stabilize at -0.02%. China, on the other hand, faces a more significant decline in its GDP. In 2025, it is projected to decline to -0.15 percent, much higher than the US in the same year.

Additionally, China’s GDP is projected to drop by -0.16% in 2025 and gradually stabilize around -0.09% by 2040. This suggests that without retaliation, the U.S. tariffs would have a modest impact on the U.S. economy but a more pronounced negative effect on China’s growth.

In the scenario with retaliation, the impact on both economies becomes more severe. The U.S. economy sees a sharper decline. Its GDP growth is projected to decline -0.07% in 2027 and stabilize around -0.03% by 2040. China’s economy also suffers more, with GDP growth declining to -0.20% in 2027 and stabilizing around -0.11% by 2040. This indicates that retaliatory measures exacerbate the negative effects on both economies, but China’s economy still shrinks more severely compared to the United States.

These numbers may seem small, but since both economies are worth trillions of dollars, even a small drop means losing billions in economic activity. Overall, the data suggests that while both economies are negatively affected, China’s economy experiences a greater contraction in both scenarios.

U.S. vs. China: Economic Growth Comparison from 2014 to 2025

Why It Matters for Consumers and Producers

Tariffs will likely hurt consumers and businesses in both the U.S. and China in the long run. It is likely that in the United States, consumers will pay higher prices for goods imported from China. Additionally, the U.S. producers could also struggle with increased costs for raw materials and have reduced access into Chinese markets.

In China, the prices of US goods might also rise, and Chinese producers could lose business due to weaker demand from the U.S. So, tariffs can be a problem for both economies, as it makes goods more expensive and disrupts trade for businesses and consumers in both countries.

A Look Back at the U.S.-China Trade War

The U.S.-China trade war started in 2018, when both countries imposed heavy tariffs on each other’s goods. It led to higher costs for businesses and increased prices for consumers in both states. The U.S. aimed to reduce its trade deficit and protect domestic industries, while China retaliated to defend its economy. Over time, the trade war disrupted global supply chains and slowed economic growth in both nations. While some U.S. industries benefited from protection, many faced higher costs and lost access to Chinese markets.

Conclusion

Summing up, the data shows that U.S. tariffs have a modest impact on the U.S. economy. However, it has a more significant adverse effect on China’s GDP growth, especially when retaliation is involved. While both economies shrink over time, China’s economy experiences a larger decline compared to the U.S. in both scenarios. Retaliation worsens the situation for both, but China remains more heavily impacted overall.

Add Comment