From smartphones and electric cars to wind turbines and military radar, the building blocks of our modern world all depend on rare earth minerals. China possesses some of the world’s largest reserves of rare earth minerals. Nearly 70% of the world’s rare earths are mined in China, while more than 90% are refined there. Additionally, 98% of the world’s rare earth magnets, used in everything from iPhones to fighter jets, are made in China.

These numbers show that China dominates the global rare earth industry and thus provides Beijing with enormous economic and geopolitical power. Other countries, including both the United States and Australia, and also India, depend on China for delivery of these critical materials.

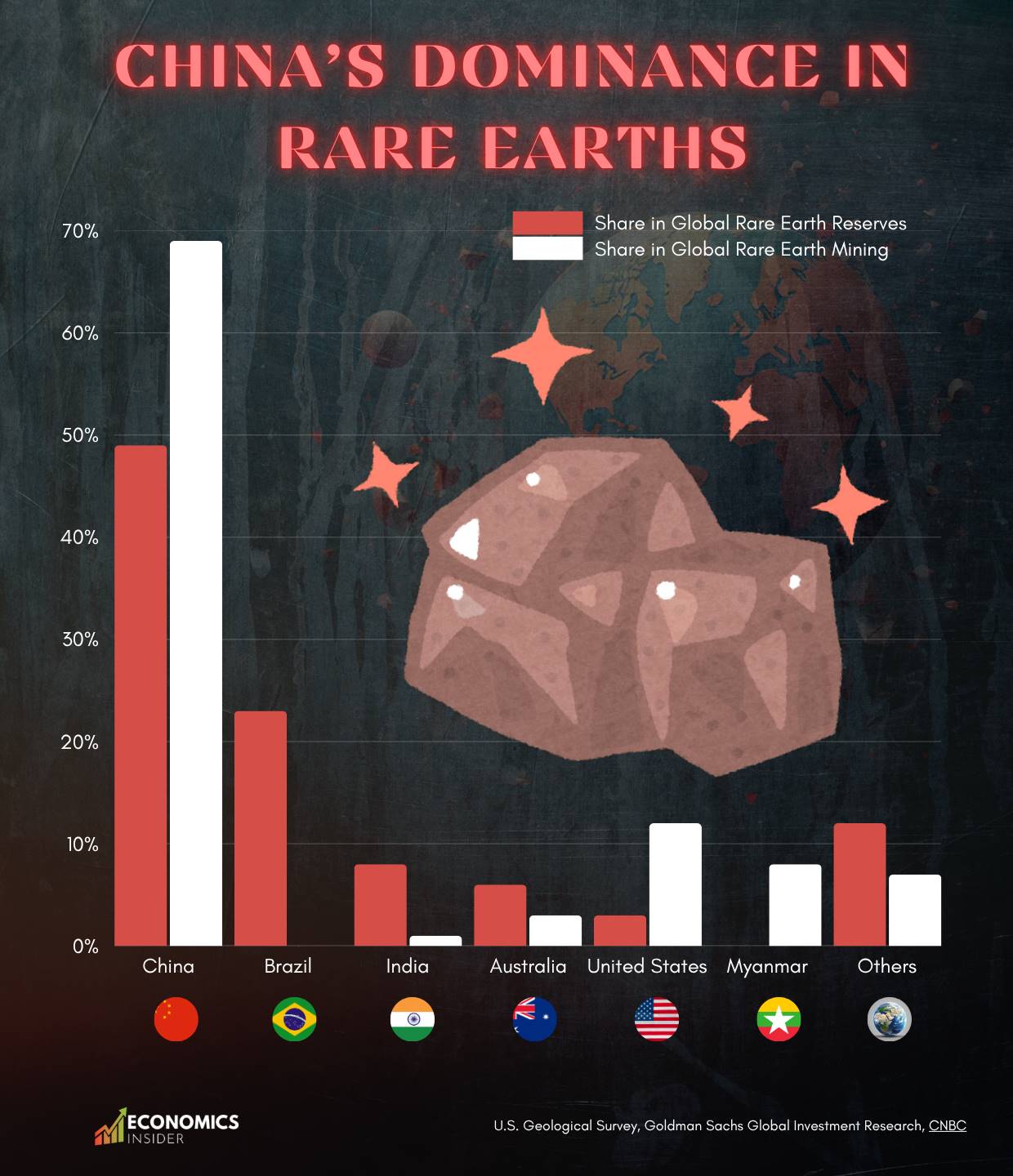

- China leads the world in rare earth mining, producing most of the global supply.

- Brazil has big reserves but does not mine much rare earth yet.

- Other countries like the U.S., Australia, and Myanmar mine small amounts compared to China.

Mine Production of Rare Earths in Major Courtiers

Despite having large reserves in several regions, most rare earth mining and production remain heavily concentrated in China.

| Country | Share in Global Rare Earth Reserves | Share in Global Rare Earth Mining |

|---|---|---|

| China | 49% | 69% |

| Brazil | 23% | 0% |

| India | 8% | 1% |

| Australia | 6% | 3% |

| United States | 3% | 12% |

| Myanmar | 0% | 8% |

| Others | 12% | 7% |

Source: U.S. Geological Survey, Goldman Sachs Global Investment Research, CNBC

What are rare earth elements, and why are they important?

Rare earths are a group of 17 elements vital to high-tech manufacturing. They’re not actually “rare” in the earth’s crust, but they’re arduous and expensive to extract. What makes them important is their unique magnetic and electronic properties, which are key to making products smaller, faster, and more energy-efficient.

Without rare earths, there would be no electric cars, renewable energy turbines, or advanced defense technologies. That’s why they’re sometimes also described as the “vitamins of modern industry.”

China: The Center of the Rare Earth World

China’s rise as a rare earth superpower did not happen overnight. Long-term planning and state support have allowed China to build a formidable rare earth industry. It granted what was needed to develop mining and refining capacity: cheap land, low-cost labor, and government funding. Today, that investment paid off: China holds 49% of the world’s reserves, 69% of the mining output, well in front of any other country.

But the real strength lies in processing. Mining is only the first step in rare earth mining; the value really begins to be added when these materials are refined into a usable material. China currently refines approximately 92% of the world’s supply, giving it almost total control over the global supply chain.

That means even if countries like the U.S. or Australia mine rare earths, they often have to send them to China for processing, making them dependent upon Beijing for finished materials.

China’s Changing Export Landscape Under Trump’s Tariffs

Comparing China to Other Key Players

Brazil holds about 23% of the world’s rare earth reserves, but it produces hardly any yet. Its industry is still in the course of development and therefore those resources are largely unexploited.

India possesses about 8% of the world’s reserves, but contributes a mere 1% to global mining. Most of its production is still small-scale and lacks advanced refining facilities.

Though Australia is considered a powerhouse in mining, it only contributes 3% of the world’s mining of rare earth metals. However, it is working hard to expand production and attract investments from Japan and the US. The United States has about 3% of reserves but manages to mine 12% of global output, mainly from the Mountain Pass Mine in California.

U.S.–China Tensions Over Rare Earths

For years, the US and its allies have depended on China for rare earths, but in the face of growing geopolitical tensions-particularly since the trade war and the tech bans-the US now considers this dependence a serious national security risk.

China has also shown just how powerful its control can be. In 2010, it briefly cut off rare earth exports to Japan following a territorial dispute, causing prices to temporarily spike around the world. In 2023, China imposed new export restrictions on gallium and germanium-two key materials used in semiconductors-signaling it could use rare earths as a political weapon once more.

In response, the U.S. is trying to rebuild its own supply chain. It has financed mining projects, subsidized firms like MP Materials, and forged closer relationships with Australia, Canada, and the European Union. But experts say it could take at least a decade for the U.S. to catch up.

The Global Race to Reduce Dependence on China

Countries from around the world are scrambling to find alternatives to China’s supply.

Australia is expanding its rare earth mining through companies like Lynas Rare Earths, which operates one of the few non-Chinese refining plants, located in Malaysia. The European Union has introduced a “Critical Raw Materials Act” aimed at increasing mining at home and recycling. Japan has also invested in rare earth projects in Vietnam and Australia for long-term supplies.

The U.S. is funding research into making rare earth extraction more eco-friendly, in addition to recycling used materials from old electronics and wind turbines.

However, such efforts are still confronted with the major challenges of environmental regulations, high costs, and years of development. Meanwhile, China continues its own expanding production and refining capacity.

Why the World Can’t Just “Replace” China

Some believe that China can be replaced quickly because all other countries have to do is mine more rare earths elsewhere, but that’s not quite how it works: refining rare earths is toxic, expensive, and technically complex. Strong acids are used in the process, and radioactive waste is produced-something many countries won’t welcome in their backyard.

China accepted these environmental costs decades ago, building huge refineries that others were unwilling to construct. That’s why, even if countries have resources, they are without infrastructure, expertise, and political will to match China’s scale. Until new technologies or cleaner methods emerge, China’s dominance probably will continue.

Conclusion

The rare earth elements might not be mentioned in everyday news headlines, but they are indeed the invisible power of modern technology, and China knows it. Beijing controls almost every step in the production chain, giving it one of the most strategic levers in the global economy. Building mines, refineries, and recycling systems takes time, and diversification is no longer optional. Until then, China’s dominance of the rare earths will shape global trade, technology, and geopolitics for years to come.